Monetary regulators in Canada this week levied $176 million in fines in opposition to Cryptomus, a digital funds platform that helps dozens of Russian cryptocurrency exchanges and web sites hawking cybercrime providers. The penalties for violating Canada’s anti money-laundering legal guidelines come ten months after KrebsOnSecurity famous that Cryptomus’s Vancouver avenue deal with was house to dozens of overseas foreign money sellers, cash switch companies, and cryptocurrency exchanges — none of which have been bodily situated there.

On October 16, the Monetary Transactions and Reviews Evaluation Heart of Canada (FINTRAC) imposed a $176,960,190 penalty on Xeltox Enterprises Ltd., extra generally often called the cryptocurrency funds platform Cryptomus.

FINTRAC discovered that Cryptomus didn’t submit suspicious transaction studies in instances the place there have been affordable grounds to suspect that they have been associated to the laundering of proceeds related to trafficking in baby sexual abuse materials, fraud, ransomware funds and sanctions evasion.

“Provided that quite a few violations on this case have been related to trafficking in baby sexual abuse materials, fraud, ransomware funds and sanctions evasion, FINTRAC was compelled to take this unprecedented enforcement motion,” mentioned Sarah Paquet, director and CEO on the regulatory company.

In December 2024, KrebsOnSecurity coated analysis by blockchain analyst and investigator Richard Sanders, who’d spent a number of months signing up for varied cybercrime providers, after which monitoring the place their buyer funds go from there. The 122 providers focused in Sanders’s analysis all used Cryptomus, and included a few of the extra outstanding companies promoting on the cybercrime boards, akin to:

-abuse-friendly or “bulletproof” internet hosting suppliers like anonvm[.]wtf, and PQHosting;

-sites promoting aged electronic mail, monetary, or social media accounts, akin to verif[.]work and kopeechka[.]retailer;

-anonymity or “proxy” suppliers like crazyrdp[.]com and rdp[.]monster;

-anonymous SMS providers, together with anonsim[.]internet and smsboss[.]professional.

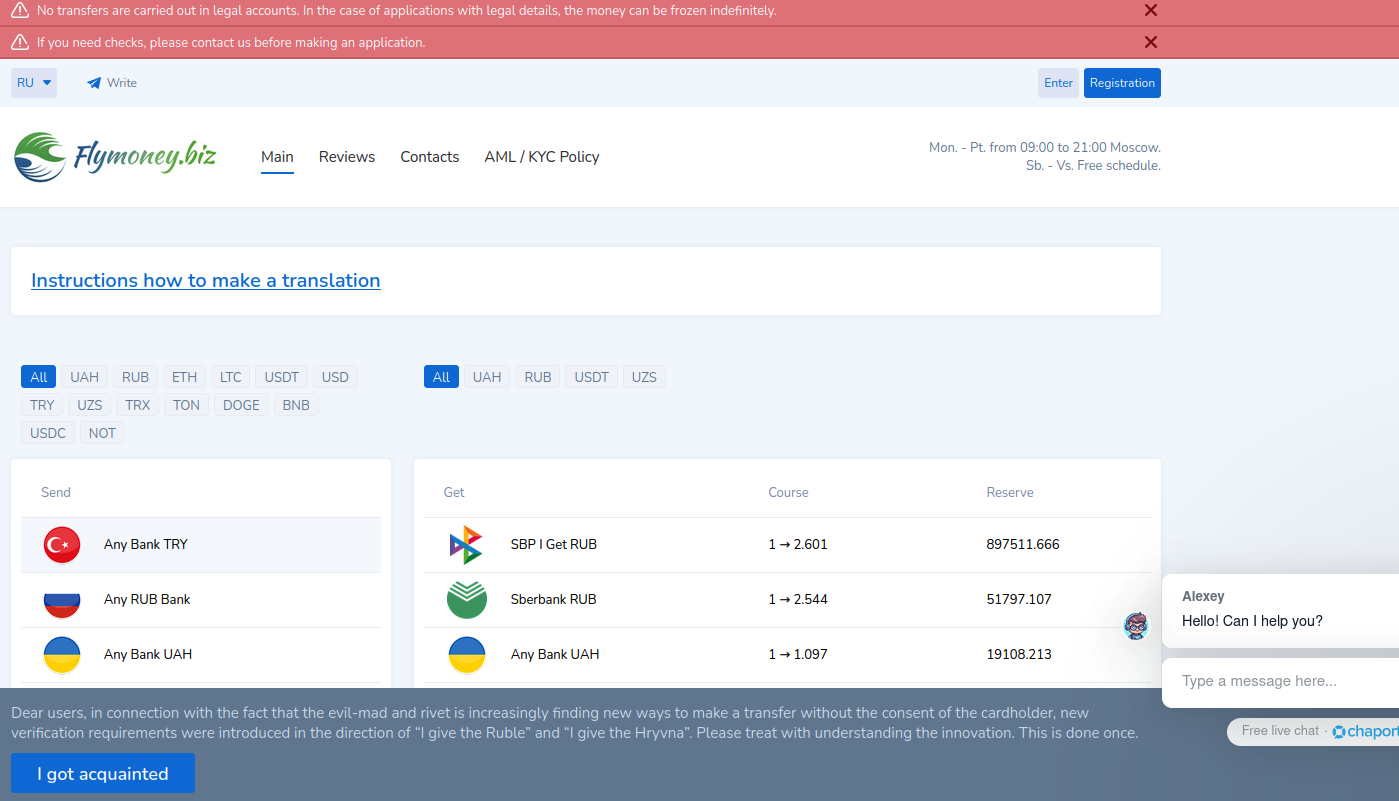

Flymoney, one among dozens of cryptocurrency exchanges apparently nested at Cryptomus. The picture from this web site has been machine translated from Russian.

Sanders discovered not less than 56 cryptocurrency exchanges have been utilizing Cryptomus to course of transactions, together with monetary entities with names like casher[.]su, grumbot[.]com, flymoney[.]biz, obama[.]ru and swop[.]is.

“These platforms have been constructed for Russian audio system, and so they every marketed the power to anonymously swap one type of cryptocurrency for one more,” the December 2024 story famous. “Additionally they allowed the change of cryptocurrency for money in accounts at a few of Russia’s largest banks — almost all of that are presently sanctioned by the US and different western nations.”

Reached for touch upon FINTRAC’s motion, Sanders instructed KrebsOnSecurity he was shocked it took them so lengthy.

“I don’t know why they don’t simply sanction them or prosecute them,” Sanders mentioned. “I’m not let down with the wonderful quantity nevertheless it’s additionally simply going to be the price of doing enterprise to them.”

The $173 million wonderful is a big sum for FINTRAC, which imposed 23 such penalties final 12 months totaling lower than $26 million. However Sanders says FINTRAC nonetheless has a lot work to do in pursuing different shadowy cash service companies (MSBs) which can be registered in Canada however are probably cash laundering fronts for entities primarily based in Russia and Iran.

In an investigation revealed in July 2024, CTV Nationwide Information and the Investigative Journalism Basis (IJF) documented dozens of instances throughout Canada the place a number of MSBs are included on the identical deal with, typically with out the data or consent of the situation’s precise occupant.

Their inquiry discovered that the road deal with for Cryptomus father or mother Xeltox Enterprises was listed as the house of not less than 76 overseas foreign money sellers, eight MSBs, and 6 cryptocurrency exchanges. At that deal with is a three-story constructing that was a financial institution and now homes a therapeutic massage remedy clinic and a co-working area. However the information retailers discovered not one of the MSBs or foreign money sellers have been paying for providers at that co-working area.

The reporters additionally discovered one other assortment of 97 MSBs clustered at an deal with for a industrial workplace suite in Ontario, though there was no proof any of those firms had ever organized for any enterprise providers at that deal with.