Cybercriminal teams peddling refined phishing kits that convert stolen card knowledge into cell wallets have not too long ago shifted their focus to focusing on clients of brokerage providers, new analysis exhibits. Undeterred by safety controls at these buying and selling platforms that block customers from wiring funds immediately out of accounts, the phishers have pivoted to utilizing a number of compromised brokerage accounts in unison to control the costs of international shares.

Picture: Shutterstock, WhataWin.

This so-called ‘ramp and dump‘ scheme borrows its identify from age-old “pump and dump” scams, whereby fraudsters buy a lot of shares in some penny inventory, after which promote the corporate in a frenzied social media blitz to construct up curiosity from different traders. The fraudsters dump their shares after the worth of the penny inventory will increase to a point, which normally then causes a pointy drop within the worth of the shares for reputable traders.

With ramp and dump, the scammers don’t must depend on ginning up curiosity within the focused inventory on social media. Moderately, they may preposition themselves within the inventory that they want to inflate, utilizing compromised accounts to buy massive volumes of it after which dumping the shares after the inventory worth reaches a sure worth. In February 2025, the FBI mentioned it was in search of data from victims of this scheme.

“On this variation, the worth manipulation is primarily the results of managed buying and selling exercise carried out by the unhealthy actors behind the rip-off,” reads an advisory from the Monetary Trade Regulatory Authority (FINRA), a non-public, non-profit group that regulates member brokerage companies. “Finally, the result for unsuspecting traders is similar—a catastrophic collapse in share worth that leaves traders with unrecoverable losses.”

Ford Merrill is a safety researcher at SecAlliance, a CSIS Safety Group firm. Merrill mentioned he has tracked current ramp-and-dump exercise to a bustling Chinese language-language group that’s fairly brazenly promoting superior cell phishing kits on Telegram.

“They may usually coordinate with different actors and can wait till a sure time to purchase a selected Chinese language IPO [initial public offering] inventory or penny inventory,” mentioned Merrill, who has been chronicling the speedy maturation and development of the China-based phishing group over the previous three years.

“They’ll use all these sufferer brokerage accounts, and if wanted they’ll liquidate the account’s present positions, and can preposition themselves in that instrument in some account they management, after which promote every thing when the worth goes up,” he mentioned. “The sufferer might be left with nugatory shares of that fairness of their account, and the brokerage might not be joyful both.”

Merrill mentioned the early days of those phishing teams — between 2022 and 2024 — had been typified by phishing kits that used textual content messages to spoof the U.S. Postal Service or some native toll street operator, warning a few delinquent transport or toll price that wanted paying. Recipients who clicked the hyperlink and supplied their cost data at a pretend USPS or toll operator web site had been then requested to confirm the transaction by sharing a one-time code despatched through textual content message.

In actuality, the sufferer’s financial institution is sending that code to the cell quantity on file for his or her buyer as a result of the fraudsters have simply tried to enroll that sufferer’s card particulars right into a cell pockets. If the customer provides that one-time code, their cost card is then added to a brand new cell pockets on an Apple or Google machine that’s bodily managed by the phishers.

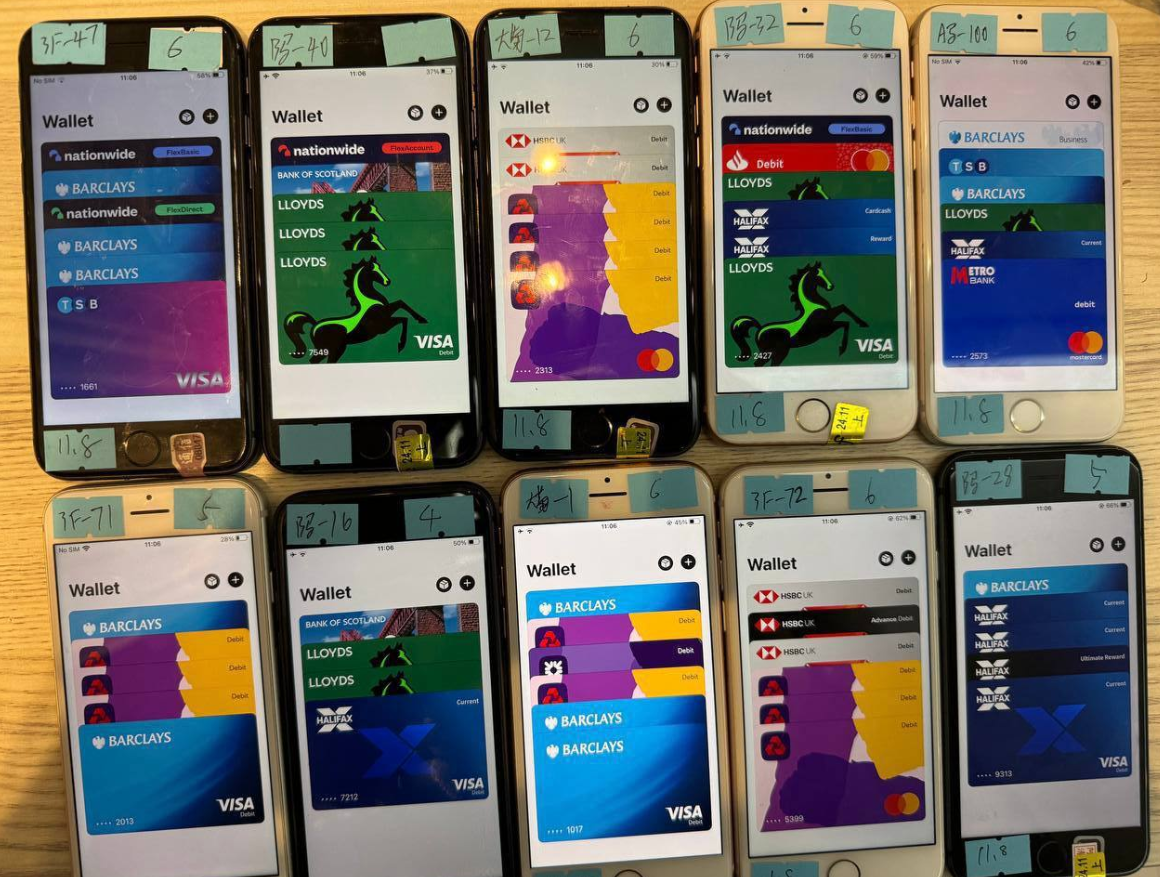

The phishing gangs usually load a number of stolen playing cards to digital wallets on a single Apple or Android machine, after which promote these telephones in bulk to scammers who use them for fraudulent e-commerce and tap-to-pay transactions.

A picture from the Telegram channel for a preferred Chinese language cell phishing package vendor exhibits 10 cell phones on the market, every loaded with 4-6 digital wallets from totally different monetary establishments.

This China-based phishing collective uncovered a serious weak spot widespread to many U.S.-based monetary establishments that already require multi-factor authentication: The reliance on a single, phishable one-time token for provisioning cell wallets. Fortunately, Merrill mentioned many monetary establishments that had been caught flat-footed on this rip-off two years in the past have since strengthened authentication necessities for onboarding new cell wallets (resembling requiring the cardboard to be enrolled through the financial institution’s cell app).

However simply as squeezing one a part of a balloon merely forces the air trapped inside to bulge into one other space, fraudsters don’t go away while you make their present enterprise much less worthwhile: They simply shift their focus to a less-guarded space. And recently, that gaze has settled squarely on clients of the foremost brokerage platforms, Merrill mentioned.

THE OUTSIDER

Merrill pointed to a number of Telegram channels operated by among the extra achieved phishing package sellers, that are filled with movies demonstrating how each characteristic of their kits could be tailor-made to the attacker’s goal. The video snippet beneath comes from the Telegram channel of “Outsider,” a preferred Mandarin-speaking phishing package vendor whose newest providing contains various ready-made templates for utilizing textual content messages to phish brokerage account credentials and one-time codes.

In response to Merrill, Outsider is a lady who beforehand glided by the deal with “Chenlun.” KrebsOnSecurity profiled Chenlun’s phishing empire in an October 2023 story a few China-based group that was phishing cell clients of greater than a dozen postal providers across the globe. In that case, the phishing websites had been utilizing a Telegram bot that despatched stolen credentials to the “@chenlun” Telegram account.

Chenlun’s phishing lures are despatched through Apple’s iMessage and Google’s RCS service and spoof one of many main brokerage platforms, warning that the account has been suspended for suspicious exercise and that recipients ought to log in and confirm some data. The missives embody a hyperlink to a phishing web page that collects the shopper’s username and password, after which asks the consumer to enter a one-time code that may arrive through SMS.

The brand new phish package movies on Outsider’s Telegram channel solely characteristic templates for Schwab clients, however Merrill mentioned the package can simply be tailored to focus on different brokerage platforms. One motive the fraudsters are choosing on brokerage companies, he mentioned, has to do with the way in which they deal with multi-factor authentication.

Schwab shoppers are introduced with two choices for second issue authentication after they open an account. Customers who choose the choice to solely immediate for a code on untrusted units can select to obtain it through textual content message, an automatic inbound telephone name, or an outbound name to Schwab. With the “at all times at login” choice chosen, customers can select to obtain the code by means of the Schwab app, a textual content message, or a Symantec VIP cell app.

In response to questions, Schwab mentioned it repeatedly updates shoppers on rising fraud tendencies, together with this particular sort, which the corporate addressed in communications despatched to shoppers earlier this 12 months.

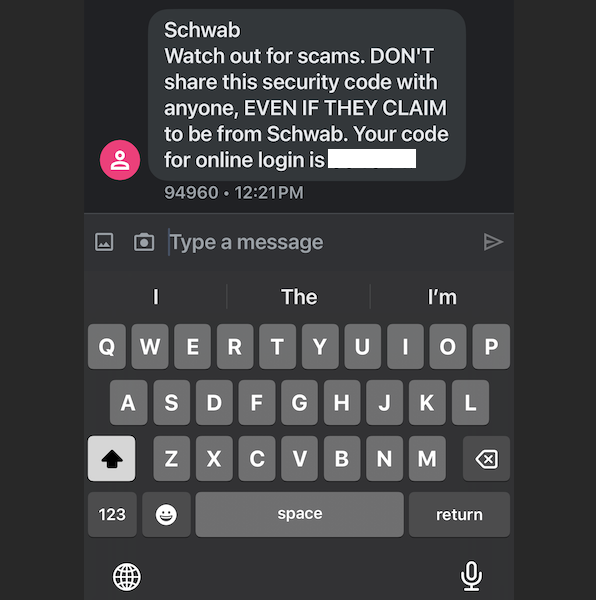

The 2FA textual content message from Schwab warns recipients towards giving freely their one-time code.

“That message targeted on trading-related fraud, highlighting each account intrusions and scams carried out by means of social media or messaging apps that deceive people into executing trades themselves,” Schwab mentioned in a written assertion. “We’re conscious and monitoring this development throughout a number of channels, in addition to others prefer it, which try to use SMS-based verification with stolen credentials. We actively monitor for suspicious patterns and take steps to disrupt them. This exercise is a part of a broader, industry-wide risk, and we take a multi-layered method to handle and mitigate it.”

Different standard brokerage platforms enable comparable strategies for multi-factor authentication. Constancy requires a username and password on preliminary login, and presents the flexibility to obtain a one-time token through SMS, an automatic telephone name, or by approving a push notification despatched by means of the Constancy cell app. Nevertheless, all three of those strategies for sending one-time tokens are phishable; even with the brokerage agency’s app, the phishers might immediate the consumer to approve a login request that they initiated within the app with the phished credentials.

Vanguard presents clients a spread of multi-factor authentication decisions, together with the choice to require a bodily safety key along with one’s credentials on every login. A safety key implements a strong type of multi-factor authentication often known as Common 2nd Issue (U2F), which permits the consumer to finish the login course of just by connecting an enrolled USB or Bluetooth machine and urgent a button. The important thing works with out the necessity for any particular software program drivers, and the great factor about it’s your second issue can’t be phished.

THE PERFECT CRIME?

Merrill mentioned that in some ways the ramp-and-dump scheme is the proper crime as a result of it leaves treasured few connections between the sufferer brokerage accounts and the fraudsters.

“It’s actually genius as a result of it decouples so many issues,” he mentioned. “They’ll purchase shares [in the stock to be pumped] of their private account on the Chinese language exchanges, and the worth occurs to go up. The Chinese language or Hong Kong brokerages aren’t going to see something funky.”

Merrill mentioned it’s unclear precisely how these perpetrating these ramp-and-dump schemes coordinate their actions, resembling whether or not the accounts are phished nicely prematurely or shortly earlier than getting used to inflate the inventory worth of Chinese language firms. The latter chance would match properly with the present human infrastructure these legal teams have already got in place.

For instance, KrebsOnSecurity not too long ago wrote about analysis from Merrill and different researchers displaying the phishers behind these slick cell phishing kits employed folks to sit down for hours at a time in entrance of huge banks of cell phones getting used to ship the textual content message lures. These technicians had been wanted to reply in actual time to victims who had been supplying the one-time code despatched from their monetary establishment.

The ashtray says: You’ve been phishing all night time.

“You may get entry to a sufferer’s brokerage with a one-time passcode, however then you definitely form of have to make use of it straight away for those who can’t set new safety settings so you’ll be able to come again to that account later,” Merrill mentioned.

The speedy tempo of improvements produced by these China-based phishing distributors is due partially to their use of synthetic intelligence and huge language fashions to assist develop the cell phishing kits, he added.

“These guys are vibe coding stuff collectively and utilizing LLMs to translate issues or assist put the consumer interface collectively,” Merrill mentioned. “It’s solely a matter of time earlier than they begin to combine the LLMs into their improvement cycle to make it extra speedy. The applied sciences they’re constructing positively have helped decrease the barrier of entry for everybody.”