“It was inevitable,” stated Jake Ostrovskis, head of OTC buying and selling at Wintermute, referring to the sell-off in digital asset treasury shares. “It acquired to the purpose the place there’s too a lot of them.”

A number of corporations have begun promoting their crypto stockpiles in an effort to fund share buybacks and shore up their inventory costs, in impact placing the crypto treasury mannequin into reverse.

North Carolina-based ether holder FG Nexus offered about $41.5 million of its tokens just lately to fund its share buyback program. Its market cap is $104 million, whereas the crypto it holds is price $116 million. Florida-based life sciences firm turned ether purchaser ETHZilla just lately offered about $40 million price of its tokens, additionally to fund its share buyback program.

Sequans Communications, a French semiconductor firm, offered about $100 million of its bitcoin this month with a purpose to service its debt, in an indication of how some corporations that borrowed to fund crypto purchases are actually struggling. Sequans’ market capitalization is $87 million, whereas the bitcoin it holds is price $198 million.

Georges Karam, chief government of Sequans, stated the sale was a “tactical resolution aimed toward unlocking shareholder worth given present market circumstances.”

Whereas bitcoin and ether sellers can discover consumers, corporations with extra area of interest tokens will discover it harder to boost cash from their holdings, based on Morgan McCarthy. “Once you’ve acquired a medical machine firm shopping for some long-tail asset in crypto, a distinct segment in a distinct segment market, it’s not going to finish nicely,” he stated, including that 95 p.c of digital asset treasuries “will go to zero.”

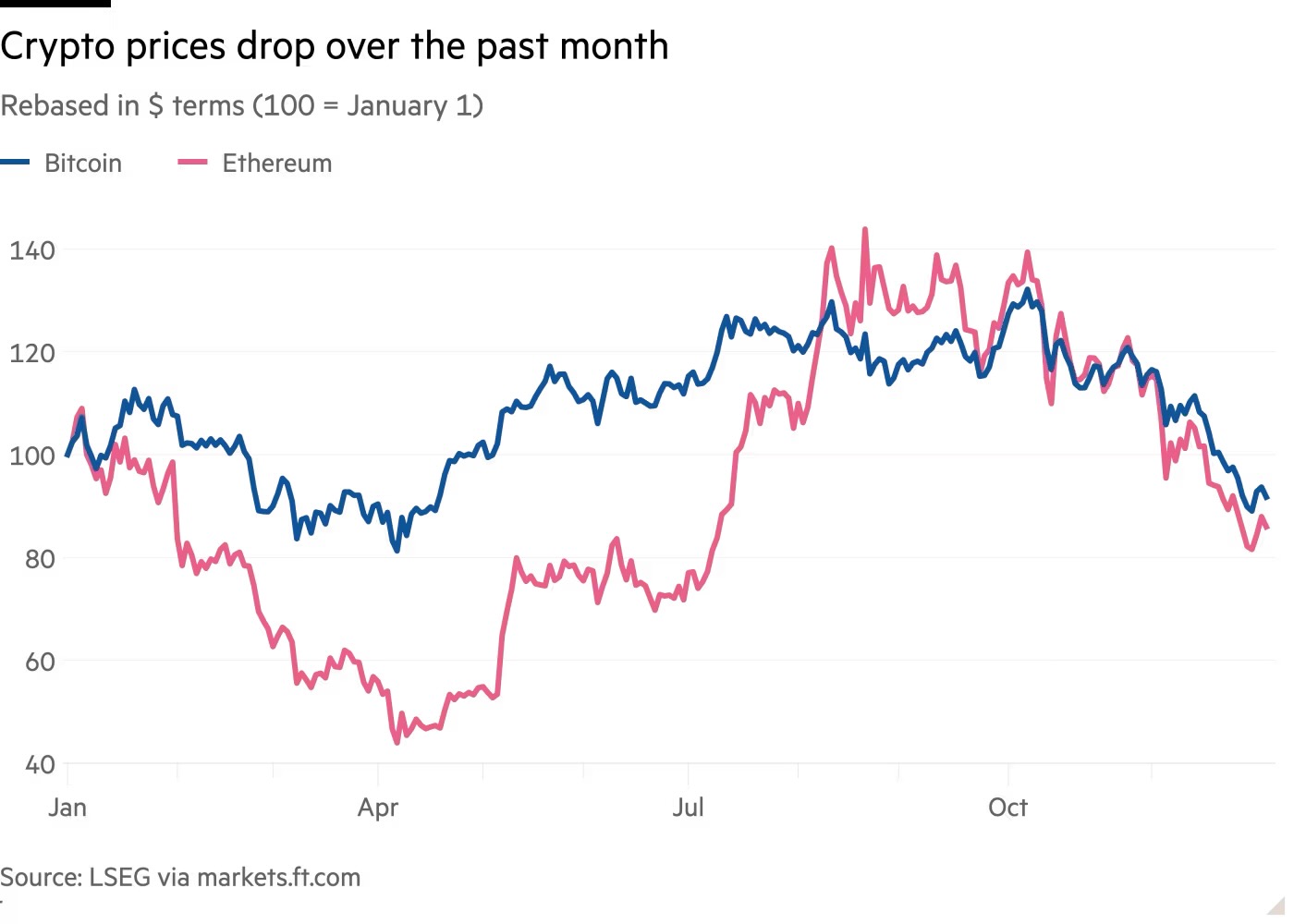

Technique, in the meantime, has doubled down and purchased much more bitcoin as the value of the token has fallen to $87,000, from $115,000 a month in the past. The agency additionally faces the looming risk of being minimize from some main fairness indices, which may heap much more promoting stress on the inventory.

However Saylor has disregarded any issues. “Volatility is Satoshi’s reward to the devoted,” he stated this week, referring to the pseudonymous creator of bitcoin.

© 2025 The Monetary Occasions Ltd. All rights reserved. To not be redistributed, copied, or modified in any means.