Cybersecurity has by no means been extra important given the exponential progress of e-commerce and on-line transactions. Hackers could try to invade our privateness in a number of methods, however one space they discover significantly attractive is bank card data. Stolen bank cards can negatively have an effect on not simply your funds however your private identification and privateness, too. Defending them and the info linked to them is crucial within the on-line world.

On this article, we delve into how cybercriminals can steal your bank card data, spotlight greatest practices to maintain you protected and clarify what to do in case your credit score or debit card is compromised.

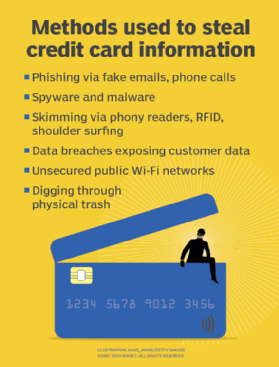

7 widespread methods bank card data is stolen

Hackers can steal credit score and debit card data in a wide range of methods, utilizing each on-line and offline strategies.

1. Phishing

Can an internet site steal your bank card data? The quick reply is sure.

With phishing, hackers try to steal invaluable data by impersonating a trusted supply. A number of phishing schemes embody faux cellphone calls, faux web sites and pretend gross sales emails. In keeping with an article by Forbes, there have been 300,497 phishing victims, with a complete lack of $52,089,159 within the U.S. reported in 2022.

For instance, somebody pretending to be out of your issuing financial institution or bank card firm calls and says they should confirm your current bank card exercise with some private data and asks to your bank card quantity. Equally, a phishing e mail despatched by an attacker posing as a retailer that gives you a reduction or free objects may very well be making an attempt to trick you into giving up fee card account particulars.

Widespread phishing makes an attempt are comparatively straightforward to identify as a result of they show traits that reliable messages don’t: concern, urgency, poor message composition and calls for that deviate from usually accepted enterprise behaviors.

In 2024 and 2025, a rash of textual content messages focused cellphone customers throughout New England, purporting to be from toll administration agency E-ZPass, demanding speedy fee for unpaid tolls. The texts originated from an unknown quantity – typically exterior the nation — didn’t check with the recipient by identify, didn’t embody any precise toll quantity, and demanded fee inside 12 hours by clicking on a vanilla URL. E-ZPass by no means sends fee notices by way of textual content. This mix of things made the rip-off straightforward to identify.

Nevertheless, scammers are upping the ante by implementing machine studying and AI instruments to construct extra real looking messaging and ship these messages in a extra focused method. Customers should all the time be vigilant and double-check account standing or fee information immediately with the precise supplier.

The way to forestall: One of the simplest ways to forestall phishing scams — whether or not by way of e mail, cellphone or textual content — is to by no means quit any private or bank card data until you initiated the contact. Additionally, go on to a retailer’s web site to conduct enterprise to make sure you management all transactions.

2. Malware and spyware and adware

Watch out what you obtain. By chance downloading malware or spyware and adware can allow hackers to entry data saved in your pc, together with bank card data and different particulars. For instance, a malware assault would possibly use a keylogger that data your keystrokes or browser historical past after which sends that data to a hacker.

It is essential to keep in mind that not simply client-side software program and gadgets will be compromised by malicious code. Server-side programs can be contaminated in in any other case reliable companies, compromising your information and that of numerous different prospects. For instance, formjacking is an assault that injects malicious JavaScript code into an internet site’s kinds to steal delicate consumer information — similar to bank card data — that’s entered throughout the common checkout course of.

The way to forestall: Keep away from downloading attachments, until they arrive from a trusted supply, and be cautious of the packages you obtain and set up on any of your gadgets. Additionally, use antivirus software program that catches malware earlier than it infects your pc. For those who’re involved about server-side dangers similar to formjacking, enter solely the minimal quantity of data wanted to finish the transaction.

3. Skimming

Bank card skimming is a well-liked offline methodology that criminals use to steal private data at some extent of sale, which may additionally result in identification theft. Contemplating that skimming requires the set up of bodily gadgets — skimmers — the observe tends to happen in additional distant places with much less monitoring and decrease human presence. The next are three types of skimming to pay attention to:

Card readers at ATMs, fuel pumps and different places will be tampered with so as to add skimming gadgets. These phony readers accumulate and cross on fee data to thieves, who clone the playing cards and use them as they see match.

The way to forestall: Examine out of doors bank card readers for indicators they might have been tampered with earlier than utilizing them.

RFID skimming makes use of radio frequency identification know-how to wirelessly intercept credit score, debit and ID data immediately from RFID-enabled playing cards — typically even smartphones and tablets. Attackers use gadgets that help near-field communication to report unencrypted information from the cardboard’s RFID chip to steal particulars similar to card numbers, expiration dates and cardholder names.

The way to forestall: Be sure that your monetary establishment has sufficient safeguards in place, together with encryption. Shielded — anti-RFID — card holders similar to wallets and purses can be useful.

4. Shoulder browsing

Shoulder browsing is an easy type of skimming that does not contain specialised know-how. A thief merely watches a consumer enter their code into an ATM or bank card data right into a cellphone. Shoulder browsing will be finished close by or distant, e.g., by way of binoculars.

The way to forestall: Protect keypads with paperwork, your physique or by cupping your hand. Concentrate on your environment and be cautious of open areas that permit informal private or social interactions — similar to espresso retailers — the place strangers can see your pc or different digital gadgets the place information may be entered. Don’t go away your sensible system unattended and shut laptops or lock tablets in the event that they should be left unattended for any time.

5. Information breaches

Sadly, high-profile information breaches have grow to be pretty widespread lately. With the quantity of knowledge saved on-line, hackers have one other avenue to steal bank card, monetary and different private data. In keeping with Verizon’s 2024 Information Breach Investigations Report, social engineering — similar to phishing texts and emails — captured private information and credentials in additional than 50% of three,032 breaches, with confirmed information disclosure that occurred from November 2022 by way of October 2023.

The way to forestall: One technique to mitigate the potential for changing into an information breach sufferer is to make use of a digital bank card — similar to Google Pockets – or a third-party fee mechanism — similar to PayPal — to take a look at at e-commerce shops with out together with your bank card data. For those who grow to be a sufferer, steps you must take embody freezing your credit score, putting a fraud alert on it and changing the cardboard affected by the breach. Additionally, acquire a duplicate of your credit score report and be vigilant about suspicious bank card exercise.

6. Public Wi-Fi networks

Unsecured public Wi-Fi networks carry some hazard when you enter delicate data when linked to them. Whereas airport or resort Wi-Fi will be handy, precautions needs to be taken to guard towards dropping bank card information and different delicate data. Moreover, be cautious of Wi-Fi designations or labels. Ought to a “Free Public Wi-Fi” entry seem in your system, it may be a hacker on a close-by smartphone or laptop computer making an attempt to get unsuspecting customers to signal on to steal their private data.

The way to forestall: Do not conduct delicate enterprise whereas linked to public networks. If you should entry these networks, use a VPN. In any other case, keep on with trusted and authenticated entry factors and service set identifiers or use your wi-fi mobile information connection.

7. Your trash

Whereas it could appear old style, criminals can dig by way of your rubbish to search out bank card statements, account data and extra that they will use to their benefit. As well as, there was a dramatic rise within the theft of mail from carriers and mailboxes to acquire printed account statements.

The way to forestall: Decide to obtain bank card statements by way of e mail. For those who obtain paper statements in any type, shred them after you not want them.

What to do in case your bank card data is stolen

Following one of the best practices on this article will assist preserve your bank card data away from hazard. However nothing is foolproof, and it’s essential to act in case your data is stolen.

This is what you must do.

1. Contact your bank card issuer

Name your financial institution or bank card firm when you suspect your card has been stolen or compromised. This could forestall additional harm and aid you keep away from legal responsibility for fraudulent purchases. Your bank card issuer will cancel your card and difficulty a brand new one.

2. Replace your passwords

Between information breaches, malware and public Wi-Fi networks, hackers can use a number of on-line strategies to steal your bank card and private data. Updating your passwords on any web sites you frequently go to can forestall hackers from accessing this information.

3. Evaluate and dispute credit score experiences

Even after you cancel your compromised bank card and get a brand new one, some fraudulent transactions you are unaware of might seem in your statements. Proceed to watch them so you may dispute any transactions that look suspicious. Credit score reporting businesses similar to Experian let folks place short-term credit score locks or fraud alerts on their credit score recordsdata. These mechanisms can forestall entry to credit score experiences, stopping credit score inquiries and new credit-based accounts from being opened with out additional investigation by the credit-issuing enterprise.

Why are you liable to repeat bank card fraud?

Though many incidents of bank card fraud are single cases — a minimum of earlier than fraudulent exercise is detected and addressed — repeat bank card fraud happens when a number of fraudulent costs on the identical or completely different bank cards victimize an individual. There are a number of widespread classifications of repeat bank card fraud, together with the next:

- Recurring fraud. This happens when unauthorized use happens on the identical card a number of occasions. For instance, a stolen card is utilized in a spending spree the place quite a few purchases are made at completely different places utilizing the identical compromised card.

- Multi-card fraud happens when unauthorized use happens on two or extra playing cards. For instance, a pockets or purse with a number of playing cards is stolen, or an information breach entails a number of fee alternate options.

The frequency and severity of repeat bank card fraud rely primarily on the actions taken by the sufferer within the aftermath of the fraud incident. The longer it takes for a sufferer to behave, the upper the chance that their bank cards will probably be used repeatedly. A failure to behave makes you extra inclined to repeat bank card fraud. Luckily, a number of easy actions can assist forestall repeat bank card fraud or mitigate its results, together with the next:

- Set and look ahead to alerts. The perfect safety towards repeat bank card fraud is well timed data and decisive motion by the sufferer. Fashionable applied sciences present real-time account exercise alerts that may be despatched to customers utilizing emails and texts. Alerts will be shortly and simply configured by way of card supplier web sites. Take the time to arrange alerts earlier than card theft or fraud happens. Customers will be alerted to fraudulent transactions in actual time when incidents occur. In some instances, victimized cardholders can block or dispute the transaction instantly.

- Lock playing cards which may have been compromised. Most bank cards now present a lock function to disable the cardboard by way of the cardboard supplier’s web site or cell app. If playing cards go lacking or transaction alerts counsel malicious exercise, lock the affected playing cards instantly and get in touch with the cardboard supplier with extra particulars. The supplier can completely disable a compromised card and instantly difficulty a substitute.

Whereas these first two steps present some speedy help, there are extra steps that may be taken later after fraud happens, together with the next:

- Evaluate bank card accounts frequently. Whether or not obtained utilizing mail or e mail, take the time to evaluation bank card — and all monetary — statements and search for indicators of suspicious exercise. Older generations used common techniques similar to “balancing the checkbook” to reconcile cash spent with checks written to make sure that balances had been right and no cash was lacking or mis-spent.

- Contact regulation enforcement. Though regulation enforcement businesses may be unable to mitigate the results of repeat bank card fraud, submitting experiences with them can assist increase their consciousness of malicious exercise and permit for higher enforcement shifting ahead. For instance, reporting a stolen pockets or purse can tip off regulation enforcement to rising prison exercise within the space. Equally, reporting information breaches or digital theft to our bodies such because the Federal Commerce Fee can set off nearer scrutiny of companies with weak safety or noncompliant information safety postures.

- Use credit score monitoring providers. Quite a few credit score monitoring providers can be found by way of credit score reporting businesses or third-party monitoring. These providers can monitor credit score experiences and scores and alert customers to modifications in credit score experiences, similar to new accounts or traces of credit score — all of which may level to suspicious exercise and potential fraud.

Finest practices to guard bank card information

Cybercriminals can use varied strategies to acquire your bank card. Some tricks to forestall this embody the next.

1. Monitor credit score experiences

Credit score monitoring and identification safety providers — similar to LifeLock and CreditLock — preserve you up to date in your bank card exercise. They’ll additionally assist get you forward of any fraudulent exercise sooner than when you manually checked your statements.

2. Monitor financial institution accounts and evaluation bank card statements for suspicious exercise

Checking credit score statements manually and monitoring Equifax, Experian or TransUnion for purchases you do not keep in mind making can provide you with a warning to unusual transactions and suspicious exercise.

3. Arrange alerts to inform of suspicious exercise

Alerts out of your financial institution by way of textual content, push notifications and e mail can assist you determine suspicious transactions quickly after they occur.

4. Use antivirus software program and VPNs

For those who’re connecting to public networks, use a VPN to guard your self from malware and hackers. To not point out, antivirus software program can defend you when you by accident obtain dangerous malware.

5. Verify web sites for a safe URL

When visiting any web site — however particularly when conducting on-line transactions — make sure the URL contains https:// and is designated as safe.

6. Do not save bank card data on web sites

It may be tempting to avoid wasting your bank card data on Google or at e-commerce websites you frequent. Nevertheless, you must keep away from this observe, because it probably supplies hackers entry to your private data within the case of an information breach. You probably have saved such data beforehand, it is easy to revisit these websites and take away fee information out of your account.

7. Use robust passwords and multifactor authentication

One other technique to keep away from being the sufferer of an information breach is to make use of robust passwords that comprise a mixture of letters, numbers and symbols. As well as, multifactor authentication — similar to receiving a six-digit code to your smartphone that may be entered into an internet site for validation — can present an added layer of safety to guard you. Think about using it when supplied. The identical goes for newer passwordless authentication strategies based mostly on biometrics — similar to facial recognition or fingerprints — or the FIDO protocols. Additionally, altering these robust passwords frequently is a routine safety behavior.

8. Do not write down your bank card data anyplace

Lastly, keep away from writing your bank card quantity, PIN and expiration date anyplace or posting photos of your card quantity on-line.

Bank cards are a typical goal for cybercriminals, and that won’t change anytime quickly, if ever. Consciousness of the strategies they use to steal private data — bank card information, particularly, however different particulars that may result in fraudulent transactions, identification theft and extra — is step one towards defending your self. Implement one of the best practices on this article to maintain your bank card data protected and take a extra energetic position in stopping your self from changing into a sufferer of fraud.