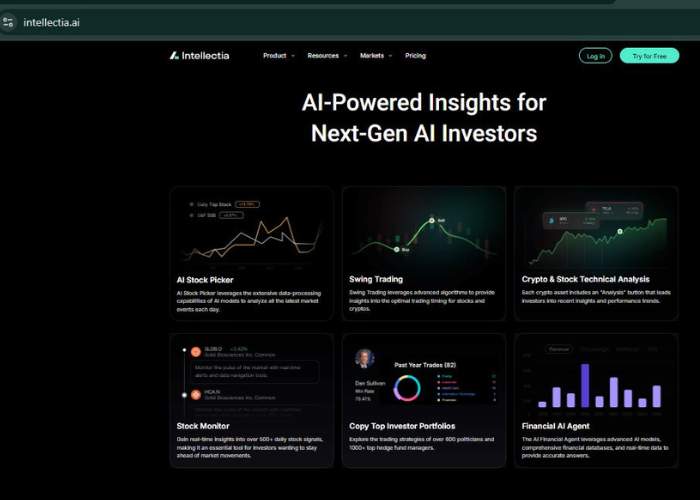

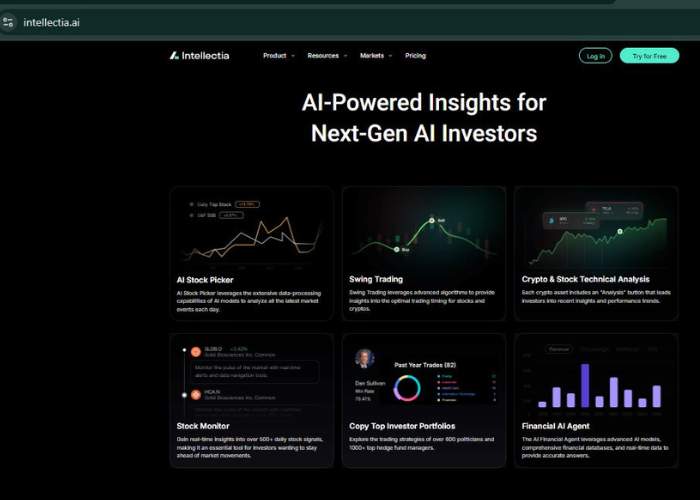

You land on Intellectia.AI anticipating a glossy AI buying and selling bot—however it’s not precisely a standard bot. As a substitute, it’s an AI-powered decision-assistant for shares and crypto: AI Inventory Picker, Swing Buying and selling indicators, sentiment evaluation, and portfolio monitoring. No direct commerce execution, simply intel and steering.

What Is It, Actually?

Intellectia.AI markets itself as a monetary intelligence platform—targeted on serving to merchants make smarter selections, not clicking a button to execute trades. That distinction issues.

Key instruments:

- AI Inventory Picker: high 5 every day inventory picks to purchase pre‑market and promote at shut, with backtested annual return reportedly >200%

- Swing Buying and selling AI: makes use of XGBoost, MLP, LLM tech to recommend entry/exit timing on shares & crypto

- Inventory Monitor / Sign Alerts: tracks 500+ indicators every day (highs, crossovers, momentum)… real-time heads-ups

- Monetary AI Agent (chatbot): ask it questions like “Ought to I purchase X at present?” and get data-driven reasoning

- Copy high investor portfolios: observe politicians and hedge funds (~600/1000+) to see what elite merchants are doing

Helpful instruments like Occasion Pushed Movers, Pivot Bottoms, and Day Buying and selling Middle assist flag market strikes, reversal zones, and sentiment-driven setups.

My Actual‑World Trial (Storytime)

I began late June—signed up for the 7‑day trial, poked round. First impression: straightforward interface, clear dashboards, chatbot that truly understands buying and selling queries. Enthusiasm spiked.

Then I attempted the AI Inventory Picker. A choose confirmed 180% annualized return historical past. I puzzled: is that legit or simply wild backtest?

Subsequent up, a swing commerce sign popped: “purchase now”—I fed it into my brokerage manually. Then market chugged sideways. Felt that sinking feeling when hype meets actual time. Emotional dip, proper? I might inform it wasn’t foolproof.

Pivot Bottoms gave me a bounce sign on a dip—took it cautiously. Chatbot helped verify. It labored, I received 1.5% fast transfer. That small win restored belief.

Monitoring a hedge fund portfolio from the “Copy” part—I noticed indicators that aligned with one supervisor’s public trades. Was cool to peek behind actual strikes.

Assist? Exams of cancellation: one consumer gave it 1★ on Trustpilot complaining billing proper earlier than finish of trial. So I stayed alert.

Breakdown of Options

| Function | What It Does | My Take |

| AI Inventory Picker | Picks 5 shares every morning to purchase/promote intraday | Enjoyable intel, however don’t blindly observe with out test |

| Swing Buying and selling AI | Sign entries/exits for shares & crypto | Helpful timing—however not magic |

| Day Buying and selling Middle | Actual-time momentum alerts, occasion‑pushed alternatives | Good for fast scalp concepts |

| Pivot Bottoms | Reversal zone detection for purchase timing | Useful when market bounces align |

| Monetary AI Agent | Chatbot solutions buying and selling questions | Nice for fast perception—simply confirm outputs |

| Copy Portfolios | Observe politicians and hedge funds’ latest trades | Fascinating to see institutional habits |

| Monitoring & Alerts | 500+ indicators per day | Pleasant oversight for lively merchants |

Professionals & Cons (within the tough)

| Professionals | Cons / Caveats |

| Wealthy suite of determination‑making instruments, not simply indicators | No precise commerce execution—guide brokerage wanted |

| Covers each shares & crypto with real-time AI fashions | Some guarantees (200% return) hinge on backtesting, not actual utilization |

| Chatbot provides conversational assist to data-driven insights | Free trial dangers auto‑cost in the event you overlook to cancel |

| Newbie-friendly, visible dashboards, nice onboarding | Requires self-discipline—not a plug‑and‑play auto‑dealer platform |

| Skill to trace elite traders and hedge funds’ trades | Threat: overfitting, mannequin failure, sentiment outlier occasions |

Emotional Rollercoaster + Perspective

Wished quick wins—received cautious indicators and guide trades. At first, pleasure, then skepticism, a little bit of frustration when swing indicators lagged. However small wins from pivot trades and venturing into portfolio monitoring introduced cautious optimism.

It’s like mountaineering with a information who provides good instructions—however you continue to gotta stroll the trail. In case you rely solely on the AI, you threat stepping off the cliff.

Studying consumer evaluations: most adore it, just a few warn about billing traps proper earlier than the trial ends. That lack of transparency shook me. All the time test cancellation phrases.

Pricing & Worth

Trial is 7 days free. Plans begin at round $14.95/month—yearly approx $11.96/month. Provides extra credibility as a result of decrease barrier to entry. For what you get—AI indicators, chatbot, portfolio insights—it’s competitively priced vs dearer bots or subscription stacks.

Who Ought to Use This?

- Rookies on the lookout for guided entry into AI-powered buying and selling.

- Swing merchants wanting timed concepts in crypto and shares.

- Individuals who like to trace high traders and sentiment occasions.

- Anybody who prefers determination assist over totally automated buying and selling.

Not ultimate in the event you count on arms‑off execution or zero guide setup. Additionally not for high-frequency quants—it’s insight-driven, not order‑execution pushed.

Options for Enchancment

- Clear billing reminders earlier than trial auto-charge.

- Broader world market protection (presently US solely)

- Cellular‑optimized dashboard (customers point out responsive design points).

- Exportable logs for deeper evaluation offline.

Remaining Verdict: Is It The Finest Assessment-Worthy Device?

Intellectia.AI impressed me as a good AI companion, not a buying and selling autopilot. It blends indicators, technical evaluation, sentiment, and chat help into one bundle. It’s not good—and it doesn’t execute trades—however for lively merchants who want insights moderately than automation, it delivers stable worth.

In case you’re keen to manually act on its steering, hold emotional management, and double‑test each AI suggestion, it may be a game-changer. However in the event you count on magic bot trades when you sleep—this isn’t it.

Ought to You Strive It?

Positively give the 7‑day trial a shot. Use it each morning: test Inventory Picker, swing indicators, monitor portfolios, ask the chatbot questions, and manually place trades in small measurement. Maintain observe of efficiency. In case you stroll away extra knowledgeable than if you began, it’s value a subscription.

In case you’d like assist constructing immediate queries for the Monetary AI Agent or tricks to take a look at swing indicators, joyful to stroll via it.