Households that mix open communication with efficient behavioral and technical safeguards can reduce the chance dramatically

30 Oct 2025

•

,

6 min. learn

Once we discuss fraud that may inflict a extreme monetary and emotional toll on the victims, it’s not hyperbole. One space the place that is more and more evident is elder fraud, because the quantities of cash misplaced to varied sorts of on-line scams climb sharply yearly.

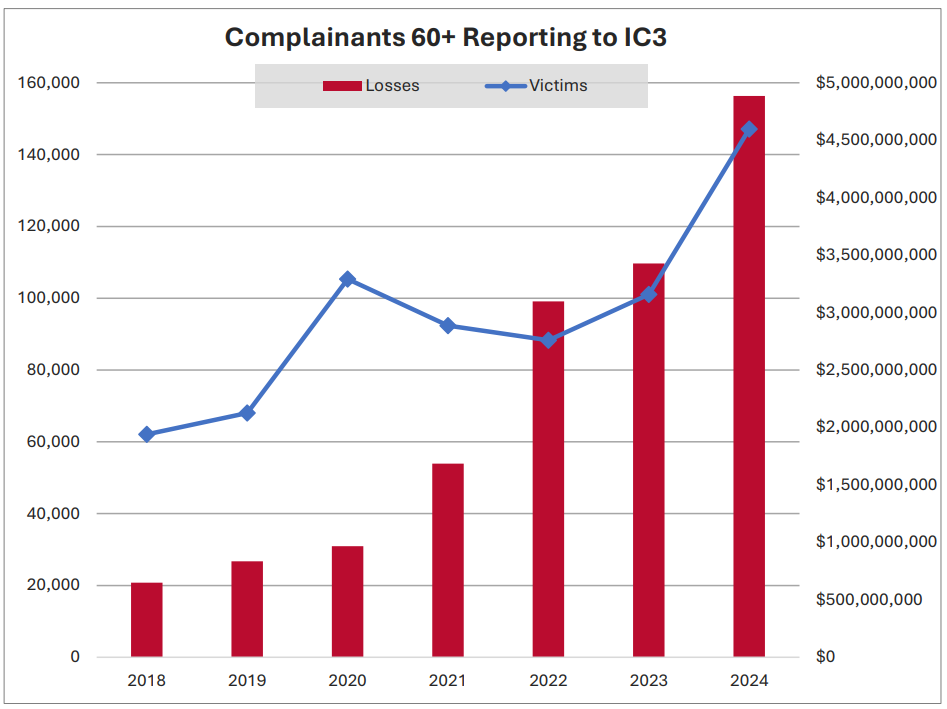

In 2024 alone, Individuals aged 60+ reported nearly $4.9 billion in losses to on-line scams, a rise of 43 % from the yr prior and a five-fold enhance from 2020, in line with the FBI’s Web Crime Heart. The typical loss from elder fraud was $83,000, in contrast with $19,000 throughout all age cohorts.

Behind these numbers are people and whole households whose well-being and monetary safety had been shaken to the core after years of financial savings evaporated in a second of misplaced belief. The sheer scale of fraud focusing on the aged is one thing that ought to make households take discover and battle again collectively.

Obscure warnings received’t reduce it, nonetheless. Efficient safety combines ongoing household communication, human and technical controls, and a transparent remediation plan if one thing does nonetheless go flawed. As October is Cybersecurity Consciousness Month, now is an effective time to take inventory of how we will help defend our dad and mom’ and grandparents’ financial savings from scammers.

Why scammers go after the aged

Scammers are rational operators: they chase revenue and low friction. Seniors are engaging targets for a number of intersecting causes:

- Entry to funds: Many seniors have money financial savings, retirement accounts or different secure sources of wealth that fraudsters see as straightforward pickings.

- Belief in authority: Generational habits round belief and authority make some older adults extra receptive to calls or letters that pose as “official.” Many seniors are unlikely to query a name from “the financial institution” or “the IRS”.

- Loneliness: Social isolation could make relationship-based scams, similar to relationship scams, devastatingly efficient.

- Cognitive overload and digital fatigue: Many seniors (let’s face it: not simply them) have a tough time managing dozens of on-line accounts, which makes them extra prone to fall for “useful” popups or pressing telephone calls.

- Expertise gaps: Many seniors use older units and outdated software program, the identical passwords throughout accounts and, identical to everybody else, typically battle to inform the actual from the pretend.

These are all primary situations that may make the attacker’s job simpler. As well as, useful attackers have useful instruments at their disposal, together with massive databases of compromised credentials accessible in underground boards to AI-driven voice cloning, that conspire to boost the “credibility” of their ploys.

The scammer playbook

Listed below are a couple of schemes that pay nice dividends to scammers focusing on older folks:

Phishing scams

Scammers can pose as IRS, Medicare or financial institution representatives, demanding cost to keep away from penalties or to “unlock” accounts. These schemes typically push victims to enter their login credentials or disclose different delicate data on web sites which might be designed to resemble these belonging to respectable entities.

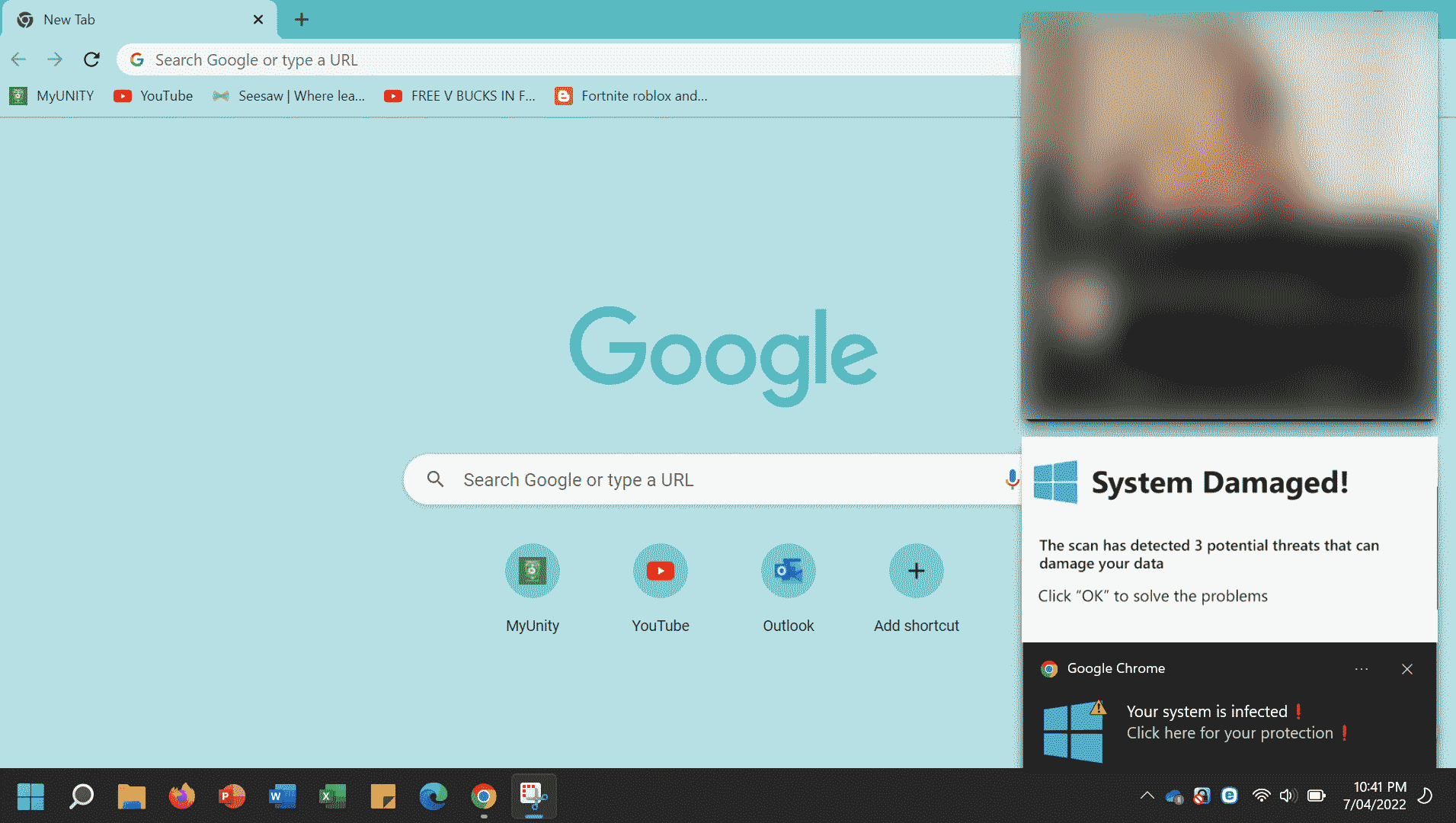

Tech assist fraud

A warning popup on a pc display or a telephone name claims that your gadget has been compromised with malware. The “assist” rep convinces you to grant distant entry, then steals banking credentials or installs infostealer malware in your gadget.

Romance scams

Fraudsters domesticate relationships with their “marks” over intervals of time spanning weeks or months, earn their belief, after which request massive wire transfers for a fabricated emergency.

Grandparent scams

A caller claims that your beloved is in bother and urgently wants cash wired. Because the ask preys on feelings, victims typically skip verification and oblige with the request, sending the cash requested by way of wire transfers, present playing cards, or money-transfer apps. These strategies are sometimes successfully irreversible.

Funding scams

Fraudsters promote pretend investments, similar to crypto schemes or high-yield “personal” choices, utilizing fabricated endorsements from well-known figures.

As fraudulent schemes more and more leverage deepfakes, scammers can clone different folks’s voices or craft movies that seem to contain members of the family or trusted public figures, making most of the ploys really feel alarmingly actual.

Beginning a dialog

Scams are lengthy recognized to invoke a way of urgency, authority and shortage to trick folks into taking motion. Even a momentary lapse in judgement, cognitive overload, stress and sleep deprivation can amplify our susceptibility to scams, which is finally why prevention is at the least as a lot behavioral as it’s technological.

One vital layer of protection will be laid with open, shame-free communication. Begin with empathy and clarify how scammers manipulate feelings – if they will trick tech-savvy folks of their 30s and 40s, anybody can develop into a sufferer.

Or share a narrative: “A good friend of mine has nearly wired a ton of cash after listening to what seemed like her grandson’s voice. It turned out to be a rip-off. Can we make a household rule that earlier than sending cash, we’ll at all times double-check?”. In different phrases, contemplate implementing a easy plan constructed round “pausing and verifying” in order that at the least one different member of the family is the go-to “verification buddy” for any monetary requests.

Additionally, in case your father or mother’s or grandparent’s financial institution provides particular protections for older prospects, use them. These could embrace verification requires some kinds of transactions, limits on new payees or holds on huge wire transfers, and alerts despatched to each the grandparent and a trusted member of the family for any switch above a specific threshold.

Fundamental gadget and account cyber-hygiene

The steps above are greatest mixed with measures that may shut commonly-exploited technological gaps. Be certain that your older kinfolk:

- use a password supervisor to generate and retailer a powerful and distinctive password for every on-line account, particularly the dear ones (e.g., banking, e mail and social media),

- whilst you’re at it, activate two-factor authentication wherever you possibly can, ideally with a cell authenticator app or perhaps a {hardware} key, reasonably than by way of SMS messages,

- block popups and robocalls utilizing safety instruments or measures accessible from telephone carriers, as acceptable,

- activate computerized updates for all units, particularly telephones, tablets, and computer systems,

- remind your kinfolk to not obtain attachments or click on on hyperlinks in unsolicited messages – when unsure, they will use ESET’s free, easy-to-use hyperlink checker,

- set up respected safety software program on all their units.

Take into account going by these steps together with your father or mother or grandparent, and depart clear (and if wanted, written) directions.

If the worst occurs

Pace is commonly of the essence. The earlier you act, the higher the possibility of recovering funds or at the least stopping additional theft. In case your (grand)father or mother falls sufferer:

- Freeze transfers instantly: Be certain that your relative’s financial institution is “within the know” so it stops any outgoing transfers.

- Doc all the things: Save telephone numbers, emails, or screenshots related to the rip-off.

- Report it: File a grievance with the FBI’s Web Crime Grievance Heart (IC3) and the FTC’s IdentityTheft.gov portal.

- Lock down credit score: Place a credit score freeze to stop new credit score accounts from being opened in your (grand)father or mother’s title.

- Present emotional assist to your kinfolk: Remind them that they’re victims of a criminal offense, reasonably than blame them. Disgrace retains folks silent, which finally solely helps scammers.

Closing ideas

For long-term peace of thoughts, contemplate additionally identification monitoring companies that provide you with a warning in case your (grand)father or mother’s social safety quantity or login credentials floor on the darkish internet. Construct a routine that entails reviewing financial institution balances, auditing transactions, and revisiting account safety settings frequently. On the finish of the day, prevention is a behavior.

The underside line is, scams focusing on seniors are rising in value, frequency and class. However households that mix open communication with efficient behavioral and technical safeguards can reduce the chance dramatically. Put these protections in place and also you’ll make it far tougher for criminals to show your (grand)dad and mom’ life financial savings into their payday.