Authorities in a minimum of two U.S. states final week independently introduced arrests of Chinese language nationals accused of perpetrating a novel type of tap-to-pay fraud utilizing cellular gadgets. Particulars launched by authorities up to now point out the cellular wallets being utilized by the scammers have been created via on-line phishing scams, and that the accused have been counting on a customized Android app to relay tap-to-pay transactions from cellular gadgets positioned in China.

Picture: WLVT-8.

Authorities in Knoxville, Tennessee final week mentioned they arrested 11 Chinese language nationals accused of shopping for tens of 1000’s of {dollars} price of reward playing cards at native retailers with cellular wallets created via on-line phishing scams. The Knox County Sheriff’s workplace mentioned the arrests are thought of the primary within the nation for a brand new sort of tap-to-pay fraud.

Responding to questions on what makes this scheme so outstanding, Knox County mentioned that whereas it seems the fraudsters are merely shopping for reward playing cards, actually they’re utilizing a number of transactions to buy varied reward playing cards and are plying their rip-off from state to state.

“These offenders have been touring nationwide, utilizing stolen bank card data to buy reward playing cards and launder funds,” Knox County Chief Deputy Bernie Lyon wrote. “Throughout Monday’s operation, we recovered reward playing cards valued at over $23,000, all purchased with unsuspecting victims’ data.”

Requested for specifics concerning the cellular gadgets seized from the suspects, Lyon mentioned “tap-to-pay fraud includes a bunch using Android telephones to conduct Apple Pay transactions using stolen or compromised credit score/debit card data,” [emphasis added].

Lyon declined to supply further specifics concerning the mechanics of the rip-off, citing an ongoing investigation.

Ford Merrill works in safety analysis at SecAlliance, a CSIS Safety Group firm. Merrill mentioned there aren’t many legitimate use instances for Android telephones to transmit Apple Pay transactions. That’s, he mentioned, except they’re working a customized Android app that KrebsOnSecurity wrote about final month as a part of a deep dive into the operations of China-based phishing cartels which can be respiration new life into the cost card fraud trade (a.ok.a. “carding”).

How are these China-based phishing teams acquiring stolen cost card information after which loading it onto Google and Apple telephones? All of it begins with phishing.

In case you personal a cell phone, the possibilities are wonderful that in some unspecified time in the future previously two years it has acquired a minimum of one phishing message that spoofs the U.S. Postal Service to supposedly acquire some excellent supply charge, or an SMS that pretends to be a neighborhood toll highway operator warning of a delinquent toll charge.

These messages are being despatched via subtle phishing kits offered by a number of cybercriminals based mostly in mainland China. And they don’t seem to be conventional SMS phishing or “smishing” messages, as they bypass the cellular networks totally. Moderately, the missives are despatched via the Apple iMessage service and thru RCS, the functionally equal expertise on Google telephones.

Individuals who enter their cost card information at one in all these websites might be instructed their monetary establishment must confirm the small transaction by sending a one-time passcode to the client’s cellular system. In actuality, that code might be despatched by the sufferer’s monetary establishment in response to a request by the fraudsters to hyperlink the phished card information to a cellular pockets.

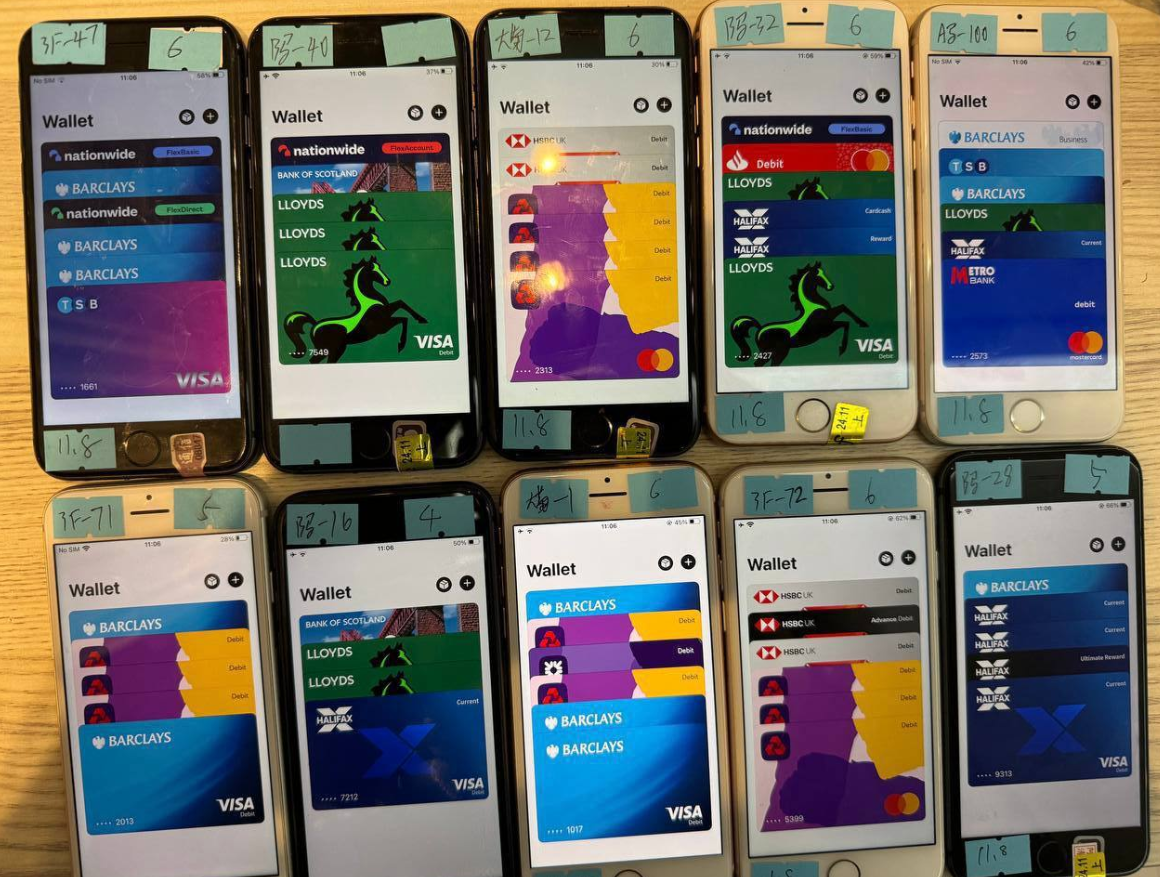

If the sufferer then offers that one-time code, the phishers will hyperlink the cardboard information to a brand new cellular pockets from Apple or Google, loading the pockets onto a cell phone that the scammers management. These telephones are then loaded with a number of stolen wallets (typically between 5-10 per system) and offered in bulk to scammers on Telegram.

A picture from the Telegram channel for a preferred Chinese language smishing equipment vendor exhibits 10 cell phones on the market, every loaded with 5-7 digital wallets from completely different monetary establishments.

Merrill discovered that a minimum of one of many Chinese language phishing teams sells an Android app known as “Z-NFC” that may relay a sound NFC transaction to anyplace on this planet. The person merely waves their telephone at a neighborhood cost terminal that accepts Apple or Google pay, and the app relays an NFC transaction over the Web from a telephone in China.

“I’d be shocked if this wasn’t the NFC relay app,” Merrill mentioned, regarding the arrested suspects in Tennessee.

Merrill mentioned the Z-NFC software program can work from anyplace on this planet, and that one phishing gang provides the software program for $500 a month.

“It might relay each NFC enabled tap-to-pay in addition to any digital pockets,” Merrill mentioned. “They even have 24-hour help.”

On March 16, the ABC affiliate in Sacramento (ABC10), Calif. aired a section about two Chinese language nationals who have been arrested after utilizing an app to run stolen bank cards at a neighborhood Goal retailer. The information story quoted investigators saying the boys have been making an attempt to purchase reward playing cards utilizing a cellular app that cycled via greater than 80 stolen cost playing cards.

ABC10 reported that whereas most of these transactions have been declined, the suspects nonetheless made off with $1,400 price of reward playing cards. After their arrests, each males reportedly admitted that they have been being paid $250 a day to conduct the fraudulent transactions.

Merrill mentioned it’s commonplace for fraud teams to promote this sort of work on social media networks, together with TikTok.

A CBS Information story on the Sacramento arrests mentioned one of many suspects tried to make use of 42 separate financial institution playing cards, however that 32 have been declined. Even so, the person nonetheless was reportedly capable of spend $855 within the transactions.

Likewise, the suspect’s alleged confederate tried 48 transactions on separate playing cards, discovering success 11 instances and spending $633, CBS reported.

“It’s fascinating that so lots of the playing cards have been declined,” Merrill mentioned. “One motive this is perhaps is that banks are getting higher at detecting any such fraud. The opposite may very well be that the playing cards have been already used and they also have been already flagged for fraud even earlier than these guys had an opportunity to make use of them. So there may very well be some ingredient of simply sending these guys out to shops to see if it really works, and if not they’re on their very own.”

Merrill’s investigation into the Telegram gross sales channels for these China-based phishing gangs exhibits their phishing websites are actively manned by fraudsters who sit in entrance of large racks of Apple and Google telephones which can be used to ship the spam and reply to replies in actual time.

In different phrases, the phishing web sites are powered by actual human operators so long as new messages are being despatched. Merrill mentioned the criminals seem to ship only some dozen messages at a time, doubtless as a result of finishing the rip-off takes handbook work by the human operators in China. In any case, most one-time codes used for cellular pockets provisioning are usually solely good for a couple of minutes earlier than they expire.

For extra on how these China-based cellular phishing teams function, try How Phished Knowledge Turns Into Apple and Google Wallets.

The ashtray says: You’ve been phishing all night time.