As transactions transfer from human clicks to autonomous choices, the fee lifecycle should evolve to deal with belief, intent, and identification in machine-led interactions.

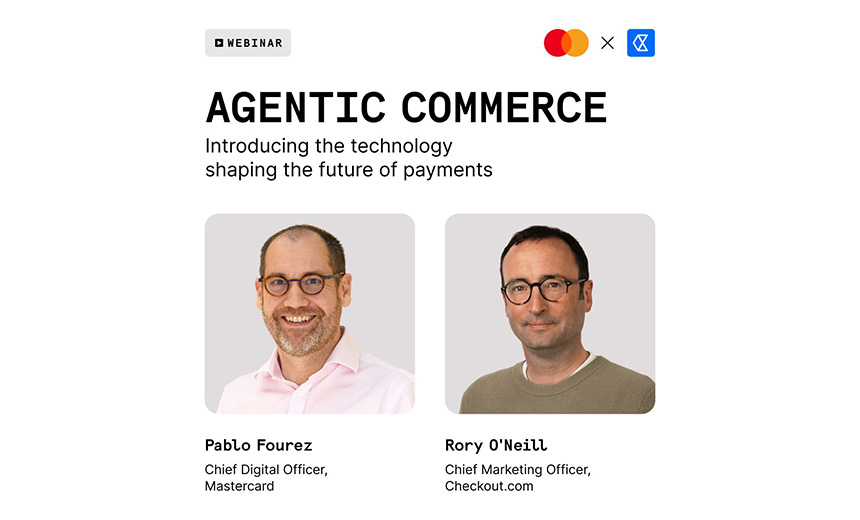

On this on-demand dialog, Pablo Fourez (Chief Digital Officer, Mastercard) and Rory O’Neill (CMO, Checkout.com) discover how agentic funds — powered by tokenization, biometric authentication, and new data-sharing requirements — are setting the inspiration for safe AI-driven commerce.

They cowl:

- Know Your Agent (KYA): How a brand new layer of identification verification helps differentiate trusted AI brokers from malicious bots in digital transactions.

- Trade Requirements and APIs: What rising protocols — from A2A agent-to-agent communication to service provider API interfaces — imply for builders, issuers, and acquirers.

- Safety and Belief Frameworks: How Mastercard’s Agent Pay mannequin combines tokenization, biometric authentication, and intent seize to make sure transparency and management.

- Fraud and Compliance within the Machine Economic system: How richer, intent-level information can scale back chargebacks, disputes, and fraudulent exercise.