If you happen to’ve been feeling like natural search visitors is getting tougher and tougher to keep up, it’s not simply you, and it’s not simply your vertical.

In our trade, we’ve largely attributed the lower in natural search clicks to the rise of AI Overviews. And whereas AIOs are actually rising in SERP presence, I needed to evaluate if there have been different components at play.

My speculation was that the rise in textual content adverts, in addition to natural SERP options, is also important culprits for the lower in basic natural search clicks throughout totally different verticals, doubtlessly much more so than AIOs.

To check this, I used Similarweb information to investigate the SERP composition evolution throughout 4 verticals: the highest 5,000 queries for headphones, denims, and on-line video games, plus the highest 956 queries for greeting playing cards & ecards within the US. For every vertical I analyzed how clicks are distributed between basic natural outcomes, natural SERP options, textual content adverts, PLAs, zero-click searches, and AI Overviews; evaluating January 2025 to January 2026.

I additionally regarded on the high domains getting each natural and paid search clicks for every vertical throughout those self same two durations, as a result of the natural story solely tells half the image. The paid visitors information reveals how manufacturers and retailers are literally responding to the natural squeeze.

The findings largely confirmed the speculation, with Textual content Adverts (and PLAs in product classes) displaying the most important year-over-year shifts in click on share. Let’s undergo the info.

1. The evolution of SERP Composition and Clicks throughout these verticals

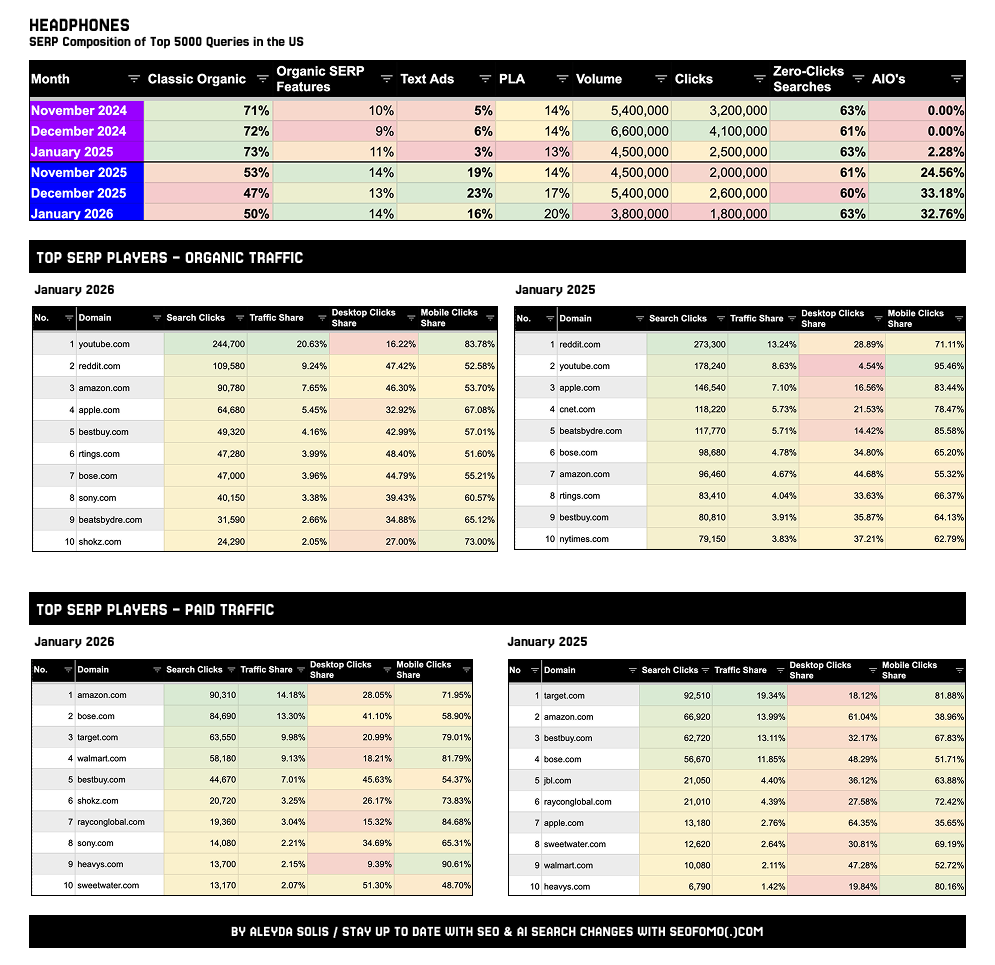

1.1. Headphones High 5K Queries SERP composition (US)

For headphones, analyzing the highest 5,000 queries within the US, I discovered the next shifts from January 2025 to January 2026:

SERP Composition: Main Shifts

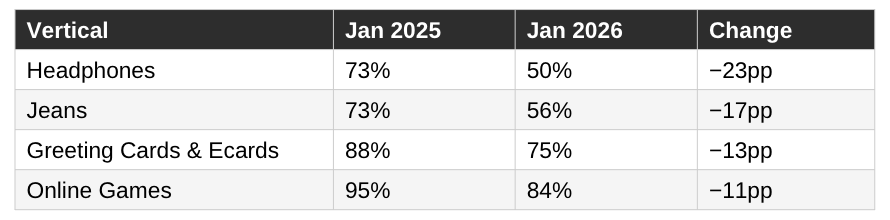

- Basic natural click on share dropped from 73% to 50%: A 23 share level decline in a single yr.

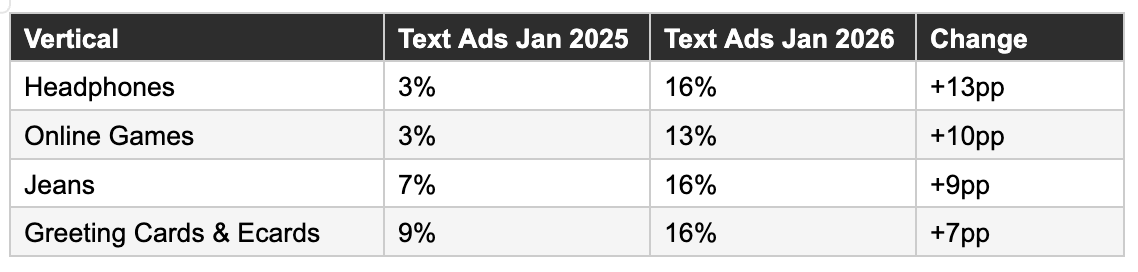

- Textual content Adverts rose from 3% to 16% (+13pp) and PLAs from 13% to twenty% (+7pp).

- PLAs additionally grew from 13% to twenty%. Mixed, paid outcomes (textual content adverts + PLAs) now seize 36% of clicks, up from 16%, greater than doubling in a single yr.

- Natural SERP options grew modestly from 11% to 14%.

- Zero-click searches remained secure at 63%.

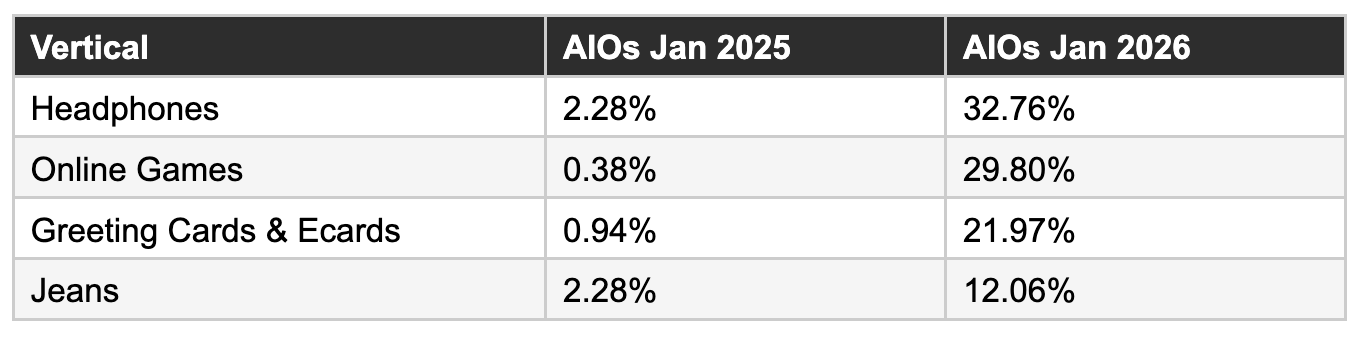

- AIO presence on SERPs exploded from 2.28% to 32.76%.

- Whole clicks from the highest 5K analyzed queries additionally declined from 2.5M to 1.8M, which means basic natural isn’t simply getting a smaller share, the full click on quantity is shrinking too (for these high queries).

Natural visitors: Who’s successful and dropping clicks:

- YouTube is the massive winner: it jumped from #2 (178K clicks) to #1 (244K): One of many only a few websites to truly develop absolute natural clicks YOY.

- Reddit noticed the most important decline: from #1 (273K) to #2 (109K), dropping 60% of its natural clicks.

- Publishers like CNET and NYTimes each disappeared from the highest 10 solely: CNET had 118K clicks in January 2025, NYTimes had 79K.

- Manufacturers like Beatsbydre collapsed from #5 (117K) to #9 (31K), Apple dropped from 146K to 64K, and Bose from 98K to 47K.

- Retailers like Amazon and BestBuy each moved up in rank (#7 to #3 and #9 to #5 respectively) however solely as a result of others fell tougher — each misplaced absolute quantity.

Paid visitors: Who’s shopping for the clicks:

- Amazon moved from #2 (66K) to #1 (90K) in paid, a +35% improve, whereas its natural clicks additionally declined yr over yr.

- Walmart noticed essentially the most dramatic shift: from #9 (10K) to #4 (58K), a virtually 6x improve, regardless of not being within the natural high 10 in any respect.

- Bose elevated from #4 (56K) to #2 (84K), a +49% improve.

- Goal fell from #1 (92K) to #3 (63K), and BestBuy declined in each natural and paid.

- DTC manufacturers like Shokz, Rayconglobal, and Heavys (which doubled from 6.7K to 13.7K) are investing closely in paid.

- The general paid competitors intensified: the #10 spot went from 6.7K clicks to 13.1K, displaying extra gamers preventing for paid clicks throughout the board.

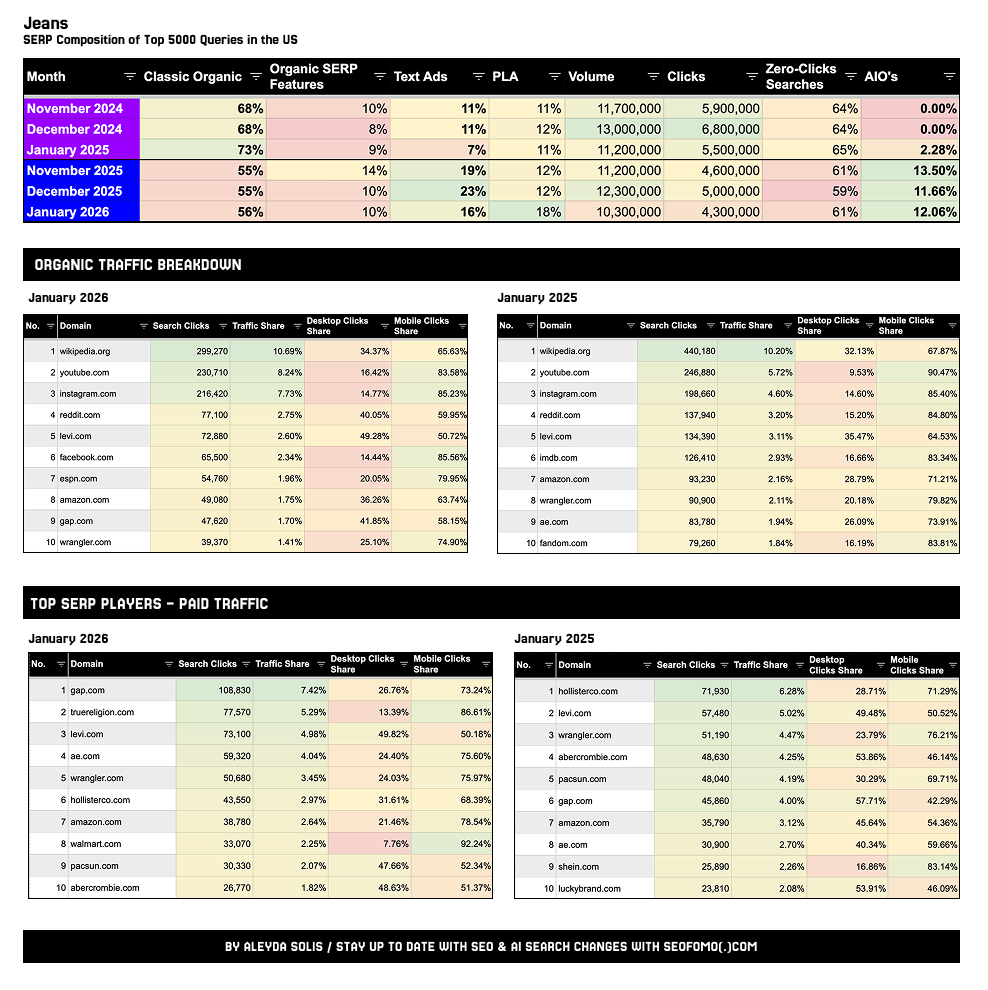

1.2. Denims High 5K Queries SERP composition (US)

For denims, analyzing the highest 5,000 queries within the US, I discovered the next shifts from January 2025 to January 2026:

SERP Composition: Main Shifts

- Basic natural click on share dropped from 73% to 56%: A 17 share level decline.

- Textual content adverts greater than doubled, going from 7% to 16% (+9pp).

- PLAs additionally grew from 11% to 18% (+7pp). Mixed, paid outcomes (textual content adverts + PLAs) now seize 34% of clicks, up from 18%.

- Natural SERP options barely moved, from 9% to 10%.

- Zero-click searches truly decreased barely from 65% to 61%.

- AIO presence grew from 2.28% to 12.06%: important however extra average in comparison with headphones.

- Whole clicks declined from 5.5M to 4.3M, so like headphones, the natural pie itself can also be shrinking (no less than the one going to high queries).

Natural visitors: Who’s successful and dropping clicks:

- The highest 3 positions are all non-retail platforms: Wikipedia (#1, 299K), YouTube (#2, 230K), and Instagram (#3, 216K). Instagram is especially notable: it grew in absolute clicks from 198K to 216K, one of many only a few websites to take action.

- Wikipedia and YouTube each misplaced absolute quantity (440K to 299K and 246K to 230K respectively) however elevated their visitors share, which means they’re declining lower than everybody else.

- Reddit dropped considerably from 137K to 77K (−44%).

- The largest losers are the normal retail and model websites: Levi went from 134K to 72K (−46%), Wrangler from 90K to 39K (−57%), and Amazon from 93K to 49K (−47%).

- Fb and ESPN entered the natural high 10 at #6 (65K) and #7 (54K) — extra social/leisure platforms filling the area that retailers and publishers misplaced.

- Hole appeared at #9 organically (47K), when it wasn’t within the natural high 10 in any respect in January 2025; whereas ae.com disappeared from the highest 10 solely, it had 83K clicks in January 2025.

Paid visitors: Who’s shopping for the clicks:

- Hole is the standout story: it went from #6 (45K) to #1 (108K), a 137% improve: The largest paid development.

- True Faith appeared at #2 with 77K paid clicks, when it wasn’t within the paid high 10 in any respect in January 2025.

- Levi grew from #2 (57K) to #3 (73K), a +27% improve.

- ae.com almost doubled its paid funding from 30K (#8) to 59K (#4).

- Walmart entered the paid high 10 at #8 (33K) regardless of having no natural high 10 presence, shopping for its manner into visibility.

- On the opposite facet, Hollisterco fell from #1 (71K) to #6 (43K), Pacsun from #5 (48K) to #9 (30K), and Abercrombie from #4 (48K) to #10 (26K).

- Shein and Luckybrand each dropped out of the paid high 10 solely.

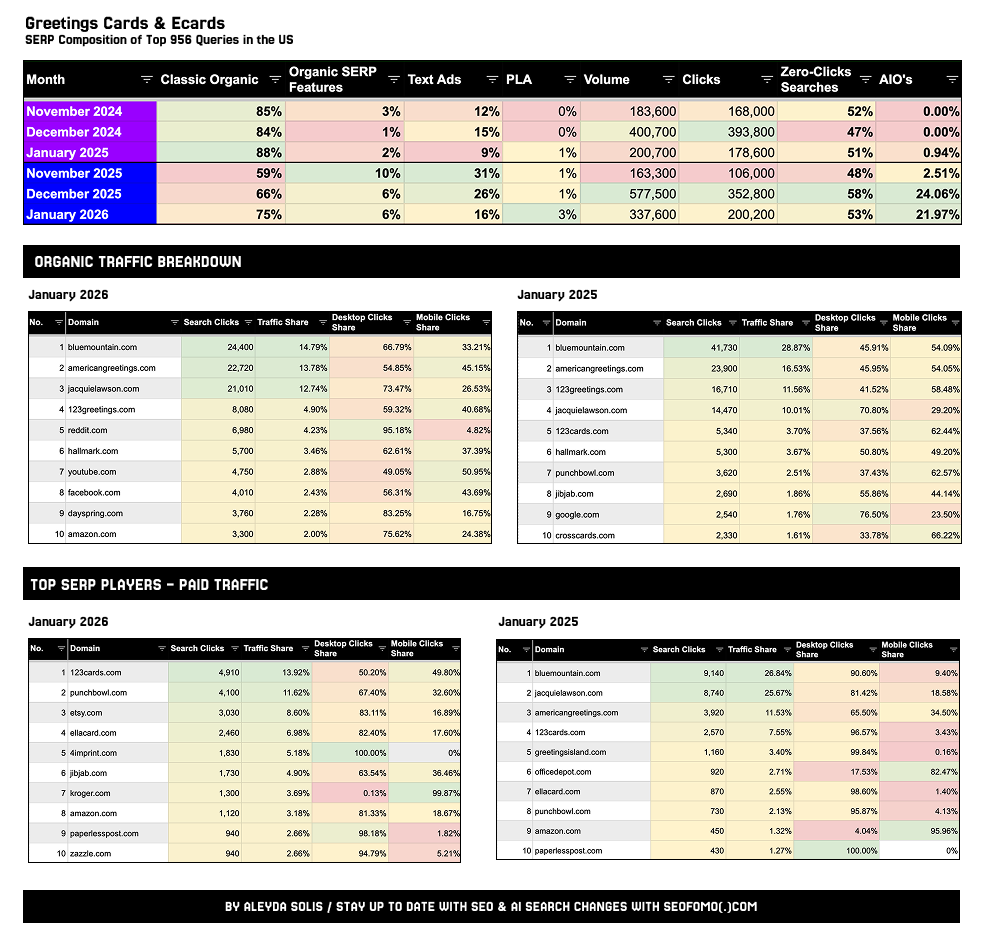

1.3. Greeting Playing cards & Ecards High 956 Queries SERP composition (US)

For greeting playing cards & ecards, analyzing the highest 956 queries within the US, I discovered the next shifts from January 2025 to January 2026:

SERP Composition: Main Shifts

- Basic natural click on share dropped from 88% to 75%: A 13 share level decline. This vertical had one of many highest natural click on share of those I analyzed in January 2025, so it had essentially the most to lose.

- Textual content adverts almost doubled from 9% to 16% (+7pp).

- PLAs grew modestly from 1% to three% (+2pp). Mixed, paid outcomes (textual content adverts + PLAs) now seize 19% of clicks, up from 10%.

- Natural SERP options tripled from 2% to six% (+4pp).

- Zero-click searches elevated barely from 51% to 53%.

- AIO presence jumped from 0.94% to 21.97%.

- Apparently, in contrast to headphones and denims, each complete search quantity (200K to 337K) and complete clicks (178K to 200K) truly elevated YOY. So the natural share is shrinking, however the general pie of high queries is rising.

Natural visitors: Who’s successful and dropping clicks:

- Bluemountain stays #1 however dropped considerably from 41K to 24K clicks (−41%). Nonetheless the dominant participant, however dropping floor quick.

- Jacquelawson.com is the shock winner: it jumped from #4 (14K) to #3 (21K), a +45% improve, one of many only a few websites throughout all verticals to meaningfully develop absolute natural clicks.

- Americangreetings held comparatively regular: from 23K to 22K, shifting from #2 to #2.

- 123greetings.com dropped sharply from #3 (16K) to #4 (8K), dropping half its natural visitors.

- Reddit, YouTube, and Fb all entered the natural high 10: At #5 (6.9K), #7 (4.7K), and #8 (4K) respectively. None of them have been within the high 10 in January 2025. The identical sample of social and UGC platforms filling natural area that we see throughout different verticals.

- 123cards, Punchbowl, Jibjab, Google.com, and Crosscards all dropped out of the natural high 10.

- Amazon and Dayspring entered the natural high 10 at #10 (3.3K) and #9 (3.7K).

Paid visitors: Who’s shopping for the clicks:

- The largest shift here’s a full change of the paid leaderboard. Bluemountain dominated paid in January 2025 at #1 (9.1K clicks) and dropped out of the paid high 10 solely in 2026. Jacquelawson did the identical: from #2 (8.7K) to nowhere within the high 10. The 2 former paid leaders primarily pulled again their advert funding.

- 123cards took over as #1 in paid (4.9K), almost doubling from #4 (2.5K) a yr in the past.

- Punchbowl noticed essentially the most dramatic development: from #8 (730 clicks) to #2 (4.1K) — a 5.6x improve.

- Etsy entered the paid high 3 at #3 (3K). It wasn’t within the paid high 10 in any respect in 2025, bringing market competitors into this area of interest.

- Ellacard almost tripled from #7 (870) to #4 (2.4K).

- A number of new entrants appeared within the paid high 10: 4imprint (#5, 1.8K), Jibjab (#6, 1.7K), Kroger (#7, 1.3K), and Zazzle (#10, 940). These are a mixture of promotional product corporations and inventive marketplaces, displaying how the aggressive panorama for paid is diversifying past conventional greeting card websites.

- Amazon greater than doubled its paid funding from 450 to 1.1K.

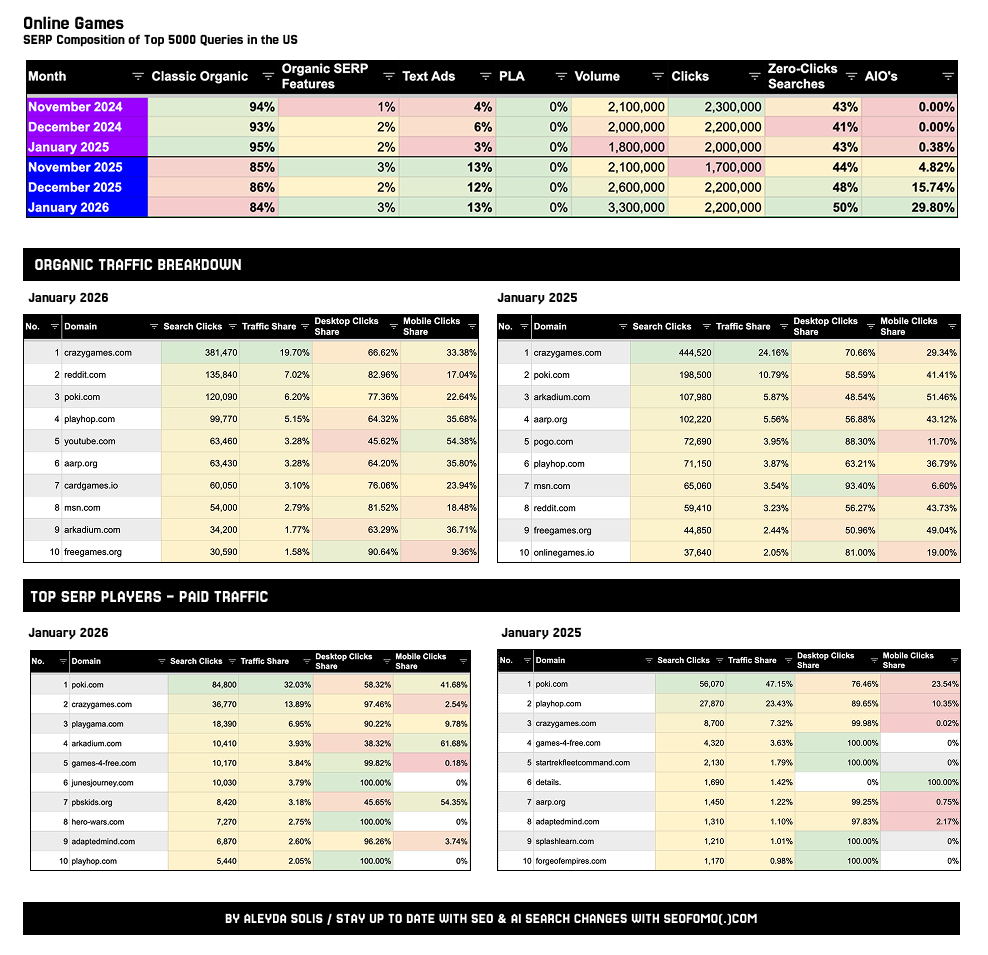

1.4. On-line Video games High 5K Queries SERP composition (US)

For on-line video games, analyzing the highest 5,000 queries within the US, I discovered the next shifts from January 2025 to January 2026:

SERP Composition: Main Shifts

- Basic natural click on share dropped from 95% to 84%: An 11 share level decline. This was essentially the most “organic-friendly” vertical of all, with the best beginning natural share.

- Textual content adverts greater than quadrupled from 3% to 13% (+10pp). That is notable for a vertical that traditionally had nearly no advert presence.

- PLAs stay at 0%, this isn’t a product vertical.

- Natural SERP options barely moved, from 2% to three%.

- Zero-click rose from 43% to 50% alongside a pointy improve in AIO presence (0.38% to 29.80%).

- AIO presence surged from 0.38% to 29.80% — the second-highest AIO development after headphones.

- Each search quantity (1.8M to three.3M) and complete clicks (2M to 2.2M) elevated YOY. It is a rising market, however the click on development didn’t preserve tempo with quantity development, suggesting extra searches are going zero-click.

Natural visitors: Who’s successful and dropping clicks:

- CrazyGames stays #1 however declined from 444K to 381K (−14%). It nonetheless dominates with almost 20% visitors share, however the hole is narrowing.

- Reddit is the most important natural winner: from #8 (59K) to #2 (135K), greater than doubling its natural clicks. An enormous bounce that mirrors the sample we see throughout different verticals.

- Poki dropped considerably from #2 (198K) to #3 (120K), dropping 39% of its natural visitors.

- Playhop bucked the development: it grew from #6 (71K) to #4 (99K), a +40% improve, one of many few gaming platforms to develop absolute natural clicks.

- YouTube entered the natural high 10 at #5 (63K): It wasn’t current in 2025. Yet one more vertical the place YouTube is gaining natural floor.

- Arkadium noticed essentially the most dramatic natural collapse: from #3 (107K) to #9 (34K), dropping 68% of its natural clicks.

- Aarp.org declined from #4 (102K) to #6 (63K), dropping 38%.

- Pogo.com and Onlinegames.io each dropped out of the natural high 10 solely — that they had 72K and 37K clicks respectively in January 2025.

- Cardgames.io entered the natural high 10 at #7 (60K).

Paid visitors: Who’s shopping for the clicks:

- The general paid market exploded: the highest 10 paid websites mixed for roughly 198K clicks in January 2026, almost double the ~106K in January 2025.

- Poki stays #1 in paid and grew from 56K to 84K (+51%), however its paid visitors share truly dropped from 47% to 32%, as a result of the general paid pie grew a lot. Poki is clearly investing closely to compensate for its 39% natural decline.

- CrazyGames had essentially the most dramatic paid escalation: from #3 (8.7K) to #2 (36K), greater than quadrupling its paid funding. This whereas additionally declining organically (444K to 381K).

- Playgama appeared at #3 with 18K paid clicks: It wasn’t within the paid high 10 in any respect in 2025. A totally new paid entrant.

- Arkadium entered the paid high 10 at #4 (10.4K): Not current in paid in 2025. This mirrors its natural lower (−68%), suggesting a strategic pivot from natural to paid.

- Playhop tells the other story: its natural grew +40% however its paid funding dropped from #2 (27K) to #10 (5.4K). One of many few websites that efficiently shifted away from paid reliance and towards natural development.

- A number of new entrants appeared within the paid high 10: Junesjourney (#6, 10K), Pbskids.org (#7, 8.4K), and Hero-wars.com (#8, 7.2K): A mixture of informal and cellular recreation manufacturers getting into paid search competitors.

- Startrekfleetcommand, Splashlearn, and Forgeofempires all dropped out of the paid high 10.

2. What do these SERP shifts inform us?

Now that we’ve gone by means of every vertical individually, let’s zoom out and take a look at what holds true throughout all 4.

2.1. Basic Natural Click on Share Is Declining Throughout Each Single Vertical

Probably the most constant discovering throughout all 4 verticals is a big year-over-year decline within the share of clicks going to basic natural outcomes from January 2025 to January 2026:

This isn’t a refined shift. Headphones misplaced almost 1 / 4 of its basic natural click on share in a single yr. Even on-line video games, which has been some of the “organic-friendly” verticals traditionally (with no PLAs and minimal adverts), dropped 11 share factors.

2.2. Textual content adverts are the most important winner throughout each vertical

Textual content adverts roughly tripled or quadrupled their click on share throughout each single vertical.

In headphones, textual content adverts gained +13 share factors; in on-line video games, +10; in denims, +9; and in greeting playing cards, +7. That is essentially the most constant discovering in your complete evaluation.

Product verticals are getting a double hit: textual content adverts + PLAs

- Headphones: PLA share went from 13% to twenty%. Mixed with textual content adverts (16%), paid outcomes now seize 36% of all clicks, up from 16% a yr in the past.

- Denims: PLA share went from 11% to 18%. Mixed with textual content adverts (16%), that’s 34% of clicks going to paid, up from 18%.

- Greeting Playing cards: PLA share grew from 1% to three%, with textual content adverts at 16%. That’s 19% complete paid, up from 10%.

The paid click on share has successfully doubled in product verticals inside only one yr.

2.3. AIO penetration is very vertical-dependent

AIO presence is rising quick throughout all 4 verticals, however the development varies dramatically: From over 30 share factors in headphones to about 10 in denims.

Essential: that is AIO presence, not click on attribution. We are able to see AIOs showing on extra SERPs, however this dataset doesn’t present what number of clicks they seize or forestall.

2.4. Zero-click searches are excessive however largely secure

- Headphones: 63% (secure YOY)

- Denims: 65% to 61% (slight lower)

- On-line Video games: 43% to 50% (notable improve, alongside an increase in AIO presence)

- Greeting Playing cards: 51% to 53% (slight improve)

Zero-click charges are excessive and largely secure (besides On-line Video games). On the identical time, Basic Natural click on share is down whereas Textual content Adverts are up in each vertical; so when clicks do occur, a bigger share goes to paid surfaces than a yr in the past.

2.5. The organic-to-paid migration cycle is self-reinforcing

Throughout verticals, the websites dropping natural clicks are the exact same ones ramping up paid funding. Amazon, Walmart, Bose, CrazyGames; they’re all compensating for natural losses by shopping for their manner again into SERPs.

Others like Hole and True Faith are leaning tougher into paid, and in True Faith’s case, it exhibits up as a serious paid participant with out showing within the natural high 10 checklist proven.

This could change into self-reinforcing in observe: as basic natural click on share declines and competitors intensifies, extra gamers seem to extend paid funding (as seen within the paid click on leaderboards shifting and/or thickening yr over yr).

2.6. The search panorama isn’t simply shifting to AI, it’s basically being remonetized.

Once I began this analysis, my speculation was that textual content adverts and natural SERP options -not simply AI Overviews- might be important culprits behind declining natural clicks.

The information confirmed this throughout all 4 verticals, and the dimensions of the textual content advert influence stunned me: they gained between +7 and +13 share factors of click on share in each vertical, making them the one greatest measurable driver of the natural decline.

Natural SERP options additionally contributed, including +1 to +4 share factors relying on the vertical. In the meantime, AIO SERP presence expanded dramatically however diversified extensively: from 12% in denims to almost 33% in headphones.

Throughout these 4 verticals, Textual content Adverts present a transparent year-over-year improve in click on share (+7 to +13pp), whereas AI Overviews present a transparent year-over-year improve in SERP presence (starting from +~10pp to +~30pp relying on the vertical). These are two separate shifts occurring on the identical time.

3. What Ought to You Do About All of This?

Based mostly on these findings, right here’s what I’d advocate:

3.1. Cease treating the natural decline as simply an “AIO downside”

Sure, AIOs are rising in SERP presence. However textual content adverts are capturing much more natural share proper now, and that’s immediately measurable.

Your aggressive evaluation ought to embody paid SERP gamers, not simply natural ones. Perceive who’s shopping for the clicks in your area and what meaning for the achievable natural click on share.

3.2. Monitor SERP composition to your particular vertical

The variations between verticals are dramatic. On-line video games nonetheless has 84% basic natural click on share, whereas headphones is at 50%. Your technique must be calibrated to your particular SERP actuality, not trade averages or generalized takes.

3.3. Put money into what natural rewards now: video, UGC, and model authority

YouTube’s development throughout verticals is a transparent sign. So is the rise of social platforms like Instagram and Reddit in natural outcomes.

Put money into the locations which are gaining natural clicks in your SERPs. On this information, that features YouTube (notably in headphones, and current in on-line video games), Reddit (notably in on-line video games), and Instagram (notably in denims).

If you happen to’re a model, you want presence and content material throughout these platforms, not simply your personal website.

3.4. Recalibrate your paid technique

If natural click on share in your vertical has dropped 11-23 share factors, your earlier organic-to-paid visitors ratio assumptions are outdated.

Paid click on share (Textual content Adverts + PLAs) elevated sharply within the product verticals right here: Headphones 16% to 36%, Denims 18% to 34%, Greeting Playing cards 10% to 19%

This may occasionally imply rising paid budgets, but it surely also needs to imply discovering efficiencies: the competitors for paid clicks is intensifying and prices will rise.

3.5. Monitor pixel visibility and click on conduct, not simply rankings

Conventional place monitoring doesn’t seize this actuality. It’s essential monitor SERP options, click on distribution, and the precise share of clicks going to natural vs. paid vs. zero-click.

Instruments like Similarweb, and others that present SERP composition information are important for understanding the place you truly stand.

3.6. Keep updated concerning the newest search shifts and check

Subscribe to the SEOFOMO publication without spending a dime to remain updated with the newest web optimization & AI Search adjustments, and begin testing primarily based on the traits and patterns you see in your vertical.